Oil in New York inched higher as the dollar weakened, with investors assessing the impact of supply curbs from Iraq and Libya on the near-term demand outlook. Futures rose 0.6% toward $53 a barrel as a weaker dollar increased the appeal of commodities like oil that are priced in the currency. Iraq pledged to cut output in January and February after pumping more than its OPEC+ quota last year, and Libyan guards halted some crude exports after a pay dispute.

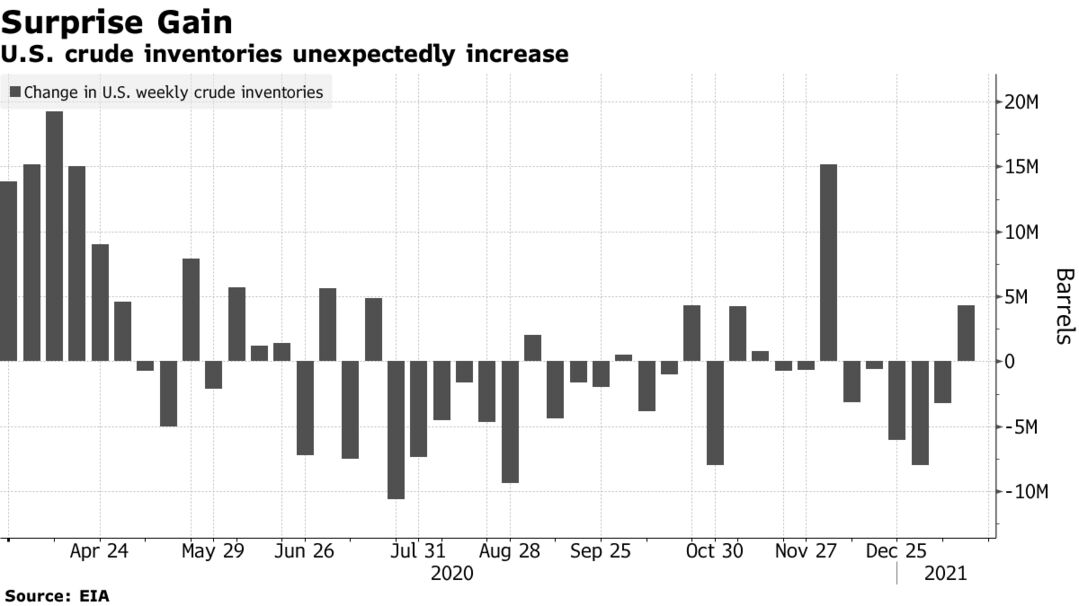

The global supply picture is mixed, however. U.S. crude inventories expanded by 4.35 million barrels in the week ended Jan. 15, a surprise gain and the first since early December, according to government data released on Friday. Most analysts surveyed by Bloomberg had predicted a draw.

Oil’s rally has stalled over the past week and a half as a resurgence of the virus in China spurred localized lockdowns, while restrictions remained in place in many European countries. Iraq, meanwhile, will pump 3.6 million barrels a day in January and February, the lowest level since early 2015.

“After Friday’s high volatility and lower close, it’s going to be a cautious start to the week,” said Vandana Hari, founder of Vanda Insights in Singapore. “Unless speculators spot a bargain and swoop in, crude may remain range-bound with a downside bias.”

| PRICES |

|---|

|