Oil extended gains on more dollar weakness and expectations U.S. President-elect Joe Biden’s incoming administration will take steps to revive growth and energy demand in the world’s largest economy. Futures in New York rose past $53 a barrel after closing up 1.2% on Tuesday. Treasury Secretary nominee Janet Yellen called on lawmakers to “act big” on stimulus, which could provide a boost to consumption while coronavirus vaccines continue to be rolled out. Weakness in the U.S. dollar raises the appeal of commodities like oil that are priced in the currency.

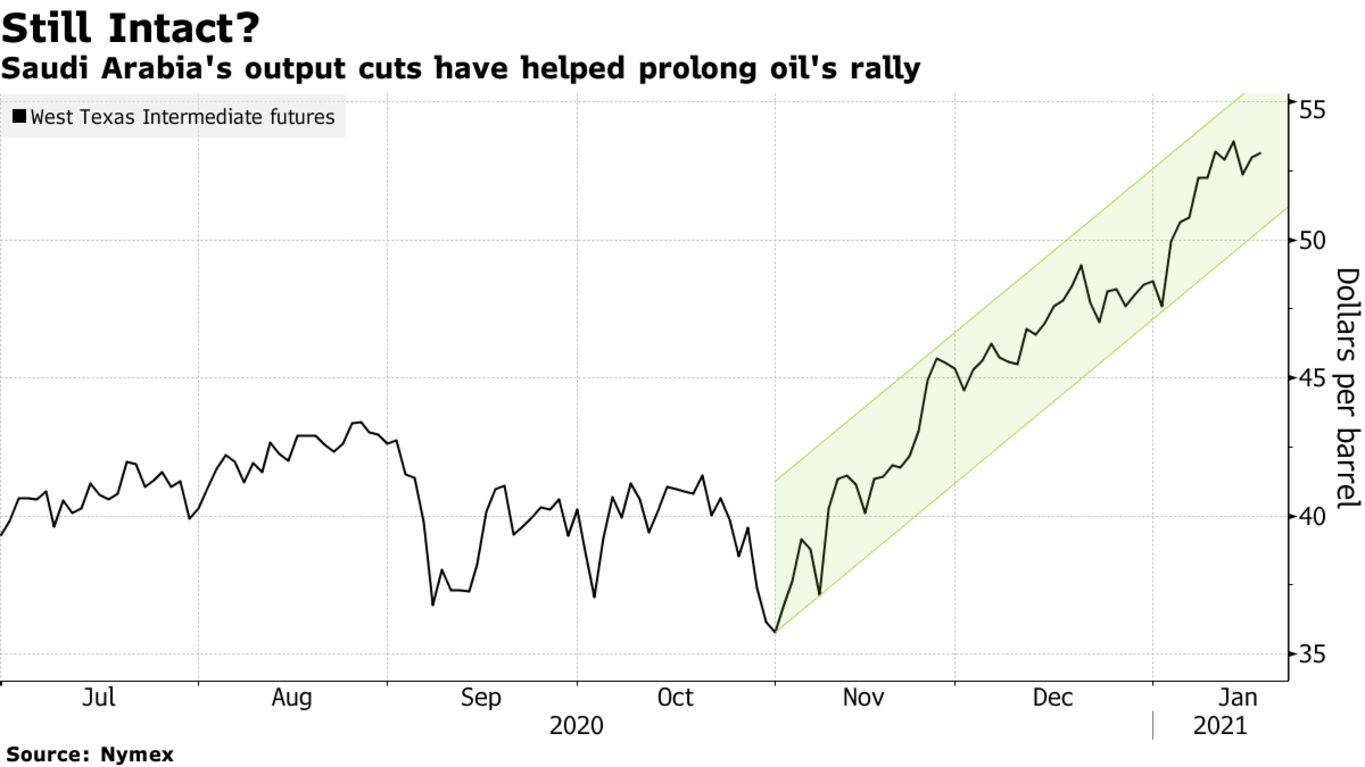

The IEA’s gloomier outlook is a validation of Saudi Arabia’s decision earlier this month to unilaterally cut production in February and March. That’s helped oil to keep rallying this year, along with a weak dollar and fund flows into commodities as a hedge against a likely acceleration in inflation this year.

“Investors are pricing in a very chunky stimulus” in the U.S. that should weaken the dollar, said Stephen Innes, chief global market strategist at Axi. “OPEC+’s current supply discipline coalescing with the Biden administration’s overarching focus on public health and economic response to the Covid-19 pandemic suggests oil prices can go much higher.”

| PRICES |

|---|

|