OPEC warned of risks to the oil market from the resurgent pandemic, a day before the group and its allies meet to consider whether to increase production. “The outlook for the first half of 2021 is very mixed,” OPEC Secretary-General Mohammad Barkindo said at a preparatory meeting on Sunday. “There are still many downside risks to juggle.”

The alliance of producers led by Saudi Arabia and Russia will decide on Monday whether it can continue to restore crude supplies without capsizing the price recovery they spent most of 2020 working to achieve.

“We think the producer group will opt to forgo any further production increases for February with Covid-19 cases continuing to climb and the slower than expected vaccine rollout,” said Helima Croft, chief commodities strategist at RBC Capital Markets LLC.

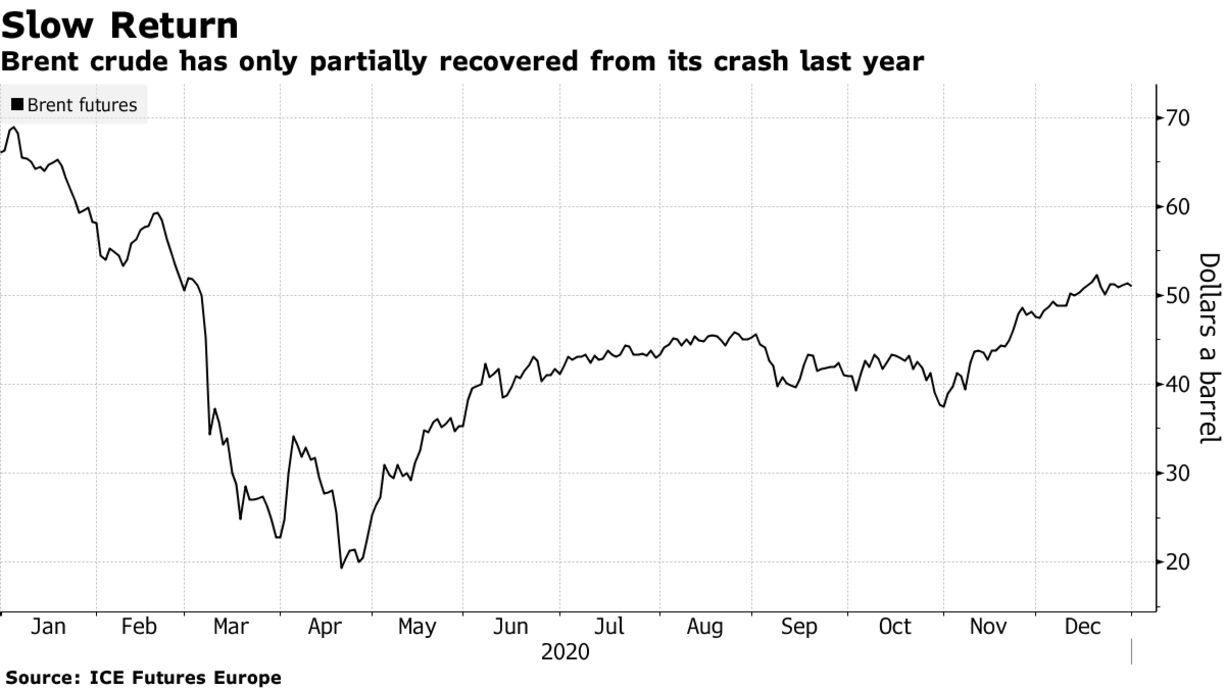

Brent crude rose for a fourth day on Monday, gaining 2.3% to $52.98 a barrel by 2:20 p.m. in Singapore. West Texas Intermediate surged toward $50, a level it hasn’t reached since February.

Whatever it ultimately decides, the Organization of Petroleum Exporting Countries and its partners are leaving nothing to chance. With the gathering on Monday, the coalition is switching to meeting every month — rather than just a few times a year — in order to fine-tune production levels more precisely.

Currently idling 7.2 million barrels a day, or about 7% of world supplies, the producers plan to return a further 1.5 million barrels a day in careful installments. Click here to follow Monday’s OPEC+ TopLive blog

The case for another small increase in February is underpinned by a recovery in the oil price, and the emergence of Covid vaccines. The vaccines have created a “healthier” outlook for oil consumption, which will soon “shift from reverse to forward gear,” Barkindo said at the Joint Technical Committee meeting on Sunday. The panel assesses implementation on behalf of the 23-nation alliance.

Russian Deputy Prime Minister Alexander Novak has signaled his readiness to proceed, saying last month that prices are in an optimal range of $45 to $55 a barrel. If OPEC+ refrains from bolstering exports, its competitors will simply fill the gap, he said.

Oil prices have stabilized above $50 barrel in London despite OPEC’s pledge of extra supply, bolstered by vaccine developments and robust fuel use in Asia. Supply and demand should remain broadly balanced in the first half of the year, according to the Paris-based International Energy Agency.

“The market has underlying support and as such should shrug off a modest increase in OPEC+ supply,” said Doug King, chief investment officer of the Merchant Commodity Fund, which manages $170 million. It’s not just Russia that might favor opening the taps.