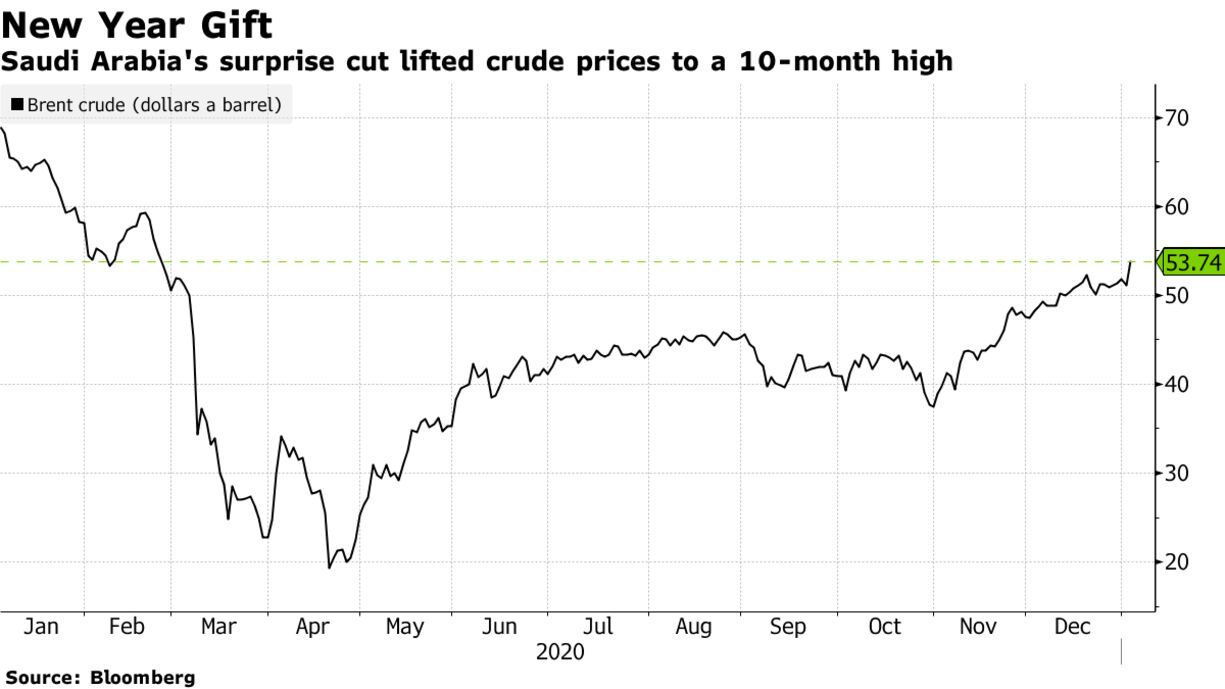

Saudi Arabia surprised the market with a large cut in crude production, an assertion of primacy over the global oil industry that came directly from the kingdom’s de-facto ruler. The move papered over cracks in the OPEC+ coalition and was a U-turn from some recent Saudi oil-policy priorities, but those things paled in comparison next to the global impact of the decision. Crude prices jumped to a 10-month high and shares of energy giants in London and shale drillers in Texas surged.

“We are the guardian of this industry,” Saudi Energy Minister Prince Abdulaziz bin Salman said as he gleefully announced the cut on Tuesday. He emphasized that the decision was made unilaterally by Crown Prince Mohammad bin Salman himself.

Since the start of the week, the oil market has been focused on the meeting between the Organization of Petroleum Exporting Countries and its allies. Since late December, Russia had been pushing for a supply hike of about 500,000 barrels a day for February, and there was reason to think it would prevail.

Hurting Speculators

Many investors were completely wrong-footed. West Texas Intermediate crude surged more than 5%, rising above $50 a barrel for the first time on Tuesday since the coronavirus pandemic took hold. The price difference between WTI futures for delivery in the final months of 2021 and 2022 — a spread known as Dec-Red-Dec that’s favored by oil-focused hedge funds — surged to a one-year high, forcing bearish investors to buy back their bets.

It was a calculated move from an oil superpower that had previously warned speculators to watch their backs.

The production increases granted to Russia and Kazakhstan, which Prince Abdulaziz said were necessary for seasonal reasons, ran counter to the longstanding Saudi mantra that all OPEC+ members should take their fair share of the burden of cuts. Countries including Nigeria, Iraq and the United Arab Emirates, have seen their past requests for special allowances to increase production rejected.