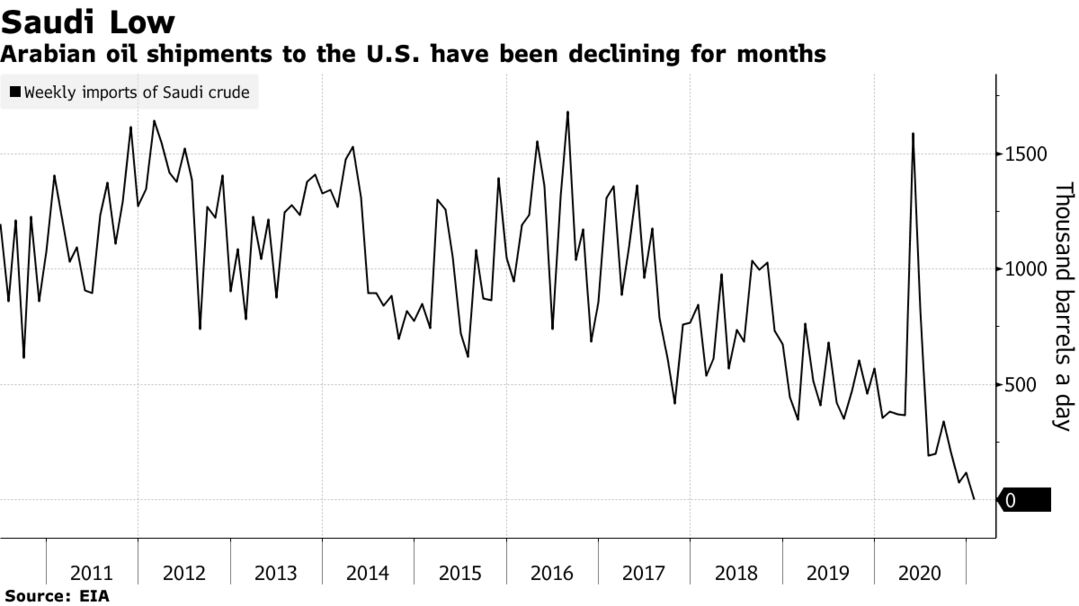

The U.S. didn’t import any Saudi crude last week for the first time in 35 years, a reversal from just months ago when the Kingdom threatened to upend the American energy industry by unleashing a tsunami of exports into a market decimated by the pandemic. Eliminating the reliance on Middle East oil has been the dream of every U.S. Administration since the presidency of Jimmy Carter in 1977. Just 12 years ago, when Joe Biden became U.S. Vice-President, American refiners were routinely importing about 1 million barrels a day of crude from Saudi Arabia, the second-largest supplier to the U.S after Canada and seen as a major security risk.

Earlier this week, OPEC and its allies reviewed their production plans, allowing small increases for Russia and Kazakhstan in February and March, with the rest keeping production unchanged. Then Saudi Arabia surprised even its fellow producers by announcing a unilateral cut to its own production of a further 1 million barrels over the next 2 months. The OPEC leader’s decision caused global benchmark Brent oil futures prices to surge beyond $54 a barrel and its U.S. counterpart, West Texas Intermediate crude, to break through $50.

The supply cuts which date back to a producer agreement last year, have helped shore up crude prices, even as fuel consumption struggles to return to pre-pandemic levels. In the past month, oil prices have risen on hopes that demand could improve as a number of vaccines are starting to be administered to combat the health crisis.

“While the U.S. imports of Saudi oil hitting zero is historic, its likely this is temporary and and only an aberration given the current low refinery runs and deep Saudi production cuts that are going to increase, against the backdrop of the ongoing pandemic environment,” said Karim Fawaz, Director of Research and Analysis for Energy at IHS Markit.

America is still in the throes of the pandemic, with record infections in many states forcing new restrictions, while some other parts of the world are recovering. U.S. gasoline consumption plunged to the lowest in years during the usual high-demand Thanksgiving and Christmas holiday periods.

The demand loss is so acute some U.S. refineries have been idled. “Throughput is still below where it was before the crisis because of reduced domestic demand. So why send more here when Asia is where recovery has been clear,” said Sandy Fielden, director of oil and products research at Morningstar Inc.