The decline of Angola, from being Africa’s top crude producer five years ago to barely pumping more than war-torn Libya today, shows the heavy toll of a slump in oil-industry investment. The nation’s production has fallen by more than a third since 2015, when international oil companies started slashing investment in response to a plunge in crude prices. Despite government efforts to stimulate activity, just a handful of drilling rigs now work in the deep Atlantic waters that hold the country’s greatest resources.

The situation could worsen as Big Oil makes another round of deep spending cuts, raising the possibility that Nigeria — another key OPEC member — could also suffer Angola’s fate. That would have consequences both for the oil market, which needs more supply from the cartel in the coming years, and the economic stability of a region that’s dependent on petroleum revenue.

“It’s a struggle for West Africa to compete” when investment is scarce, said Gail Anderson, principal analyst for West Africa upstream oil and gas at Wood Mackenzie Ltd. in Edinburgh. When returns are compared to other oil provinces, “Nigeria doesn’t stack up, nor does Angola.”

Spending Hold

Angola’s oil sector shows the aftermath of peak investment

Source: Rystad Energy UCube

Angola’s oil production figures tell a bleak picture, especially for a economy that’s heavily dependent on petroleum exports. Crude output has held at a 15-year low of just below 1.2 million barrels a day since November, according to data compiled by Bloomberg.

The seeds of this decline were sown in 2014, when surging U.S. shale production caused a price slump. As Brent crude fell from above $100 a barrel to less than $30 within a couple of years, international oil companies slashed spending around the world.

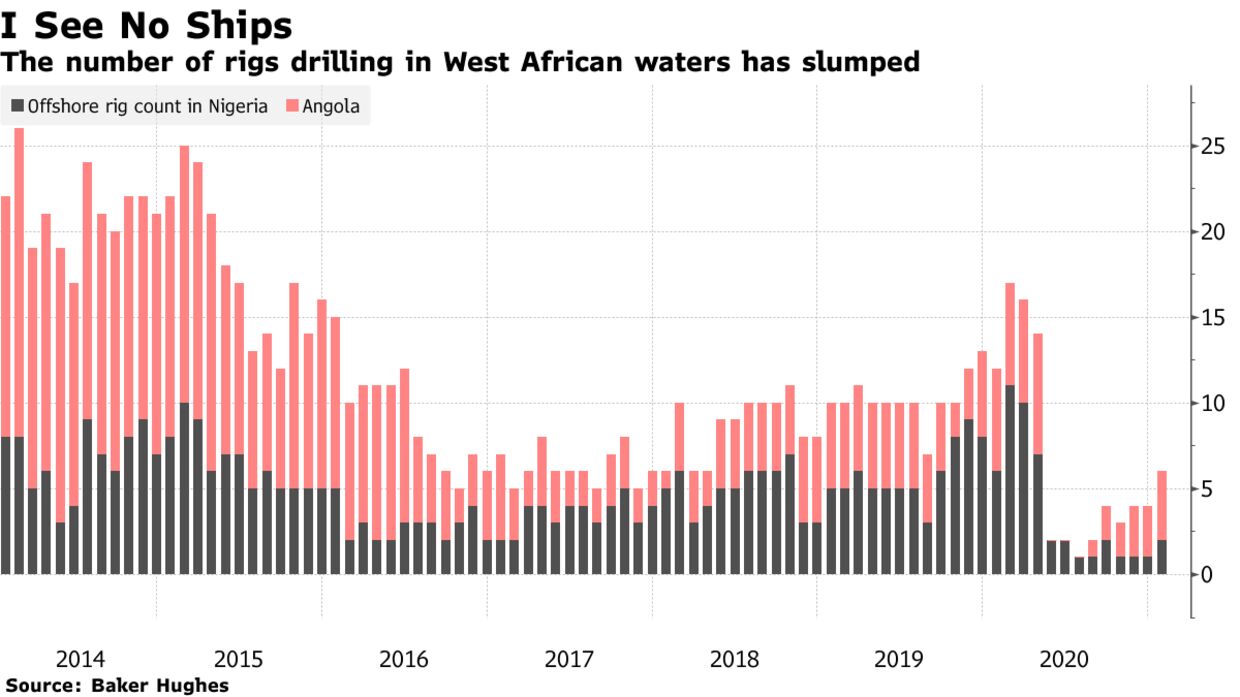

Deep production cuts by the Organization of Petroleum Exporting Countries and its allies eventually spurred a rebound in prices, but offshore drilling in West Africa recovered far more slowly. Then the coronavirus pandemic triggered another deep plunge in oil prices, leaving just a single drillship operating in the waters off Nigeria and Angola by the middle of 2020, according to data from Baker Hughes Inc.