Brent crude briefly surpassed $65 a barrel for the first time in a year as a cold blast that’s pummeled U.S. oil production escalated into a global supply shock. More than 4 million barrels a day of U.S. oil output — about 40% of crude production — is now offline, according to traders and executives, amid an unprecedented cold snap that’s frozen well operations and led to widespread power cuts. A spate of refinery outages has curbed demand for crude in the country, however, while gasoline consumption is also down as the icy conditions keep many Americans off the roads.

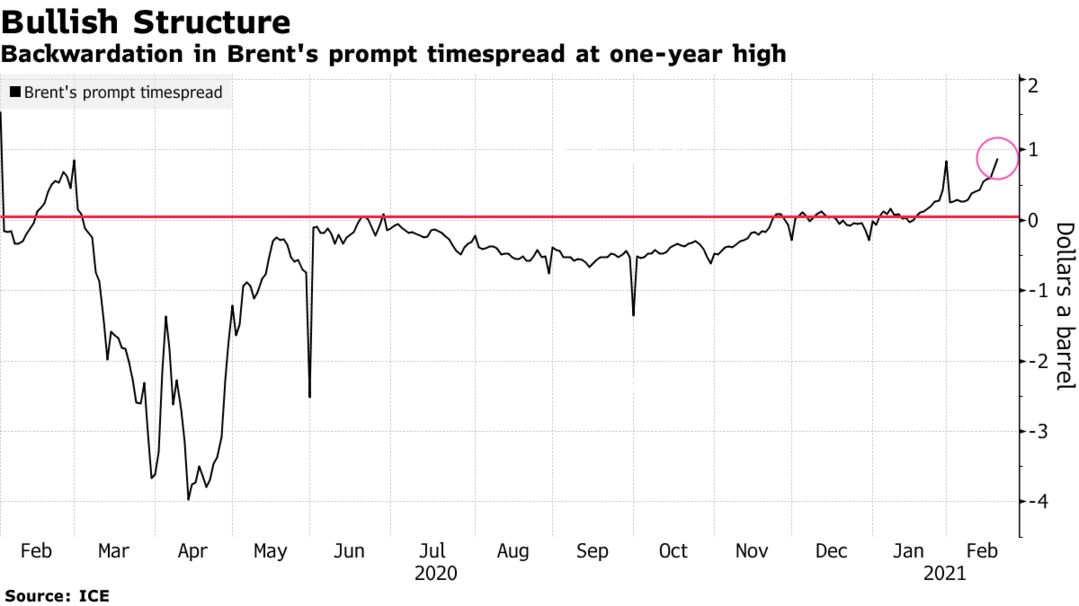

The supply shock is aiding an already frothy global oil market and is starting to alter energy flows, with traders snapping up ocean-going tankers to haul millions of barrels of European diesel to the U.S. Adding to the upward momentum, the American Petroleum Institute reported a drop of almost 6 million barrels in U.S. crude stockpiles. Government data is due later on Thursday. Brent’s prompt timespread moved further into a bullish backwardation structure, reflecting the tightening global supply backdrop.

Estimates for how long the U.S. outages may last have risen in recent days as analysts try to figure out the timespan involved in thawing out infrastructure. As American barrels are removed from the market, North Sea traders have been frantically bidding for the region’s cargoes. Buyers in Asia, meanwhile, have been snapping up Middle Eastern crude at higher premiums.

“The outage will be temporary but it will still help to accelerate U.S. oil inventories down towards the five year average quicker than expected,” said Bjarne Schieldrop, chief commodities analyst at SEB AB.

| PRICES |

|---|

|