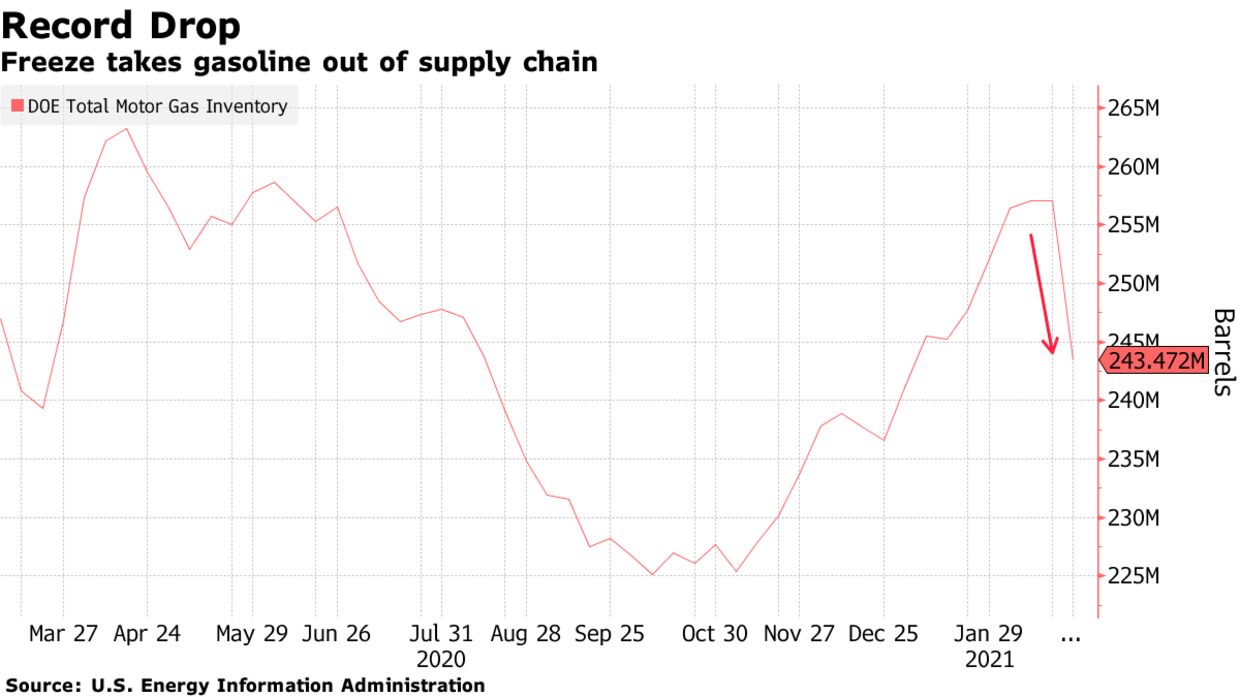

A record plunge in gasoline stockpiles last week is threatening to raise pump prices across America above $3 a gallon for the first time in six years. Inventories fell by 13.6 million barrels — the most in weekly data that goes back to 1990 — after a deep freeze paralyzed much of the Gulf Coast refining sector, according to the U.S. Energy Information Administration. Demand for the fuel meanwhile rose by the most since May.

It may take at least another week to completely restart everything shut by the storm. Six of 16 refineries in Texas shut because of the winter storm have restarted all impacted units and are in the process of ramping up production.

The margin of profit on refining crude oil into gasoline and diesel, known as the crack spread, is trending near its highest since February of 2020, with the exception of the day crude futures fell below zero. Gasoline futures in New York are nearing $2 per gallon for the first time since May 2019 after surging almost 40% so far this year.

“We might see some localized shortages, and gas prices could go up,” said Trisha Curtis, chief executive officer of oil analysis firm PetroNerds in Denver. “We would expect production to return with refining margins still climbing.” Many refineries were running below capacity during the pandemic to avoid swelling inventories with the unused product. Refinery utilization may increase as refineries ramp back up ahead of the summer holiday.

“Folks are going to the national parks and the state parks for road trips now,” Horace Hobbs, chief economist at refiner Phillips 66, said this week at the CeraWeek virtual energy conference. “That uses a lot of gasoline.”