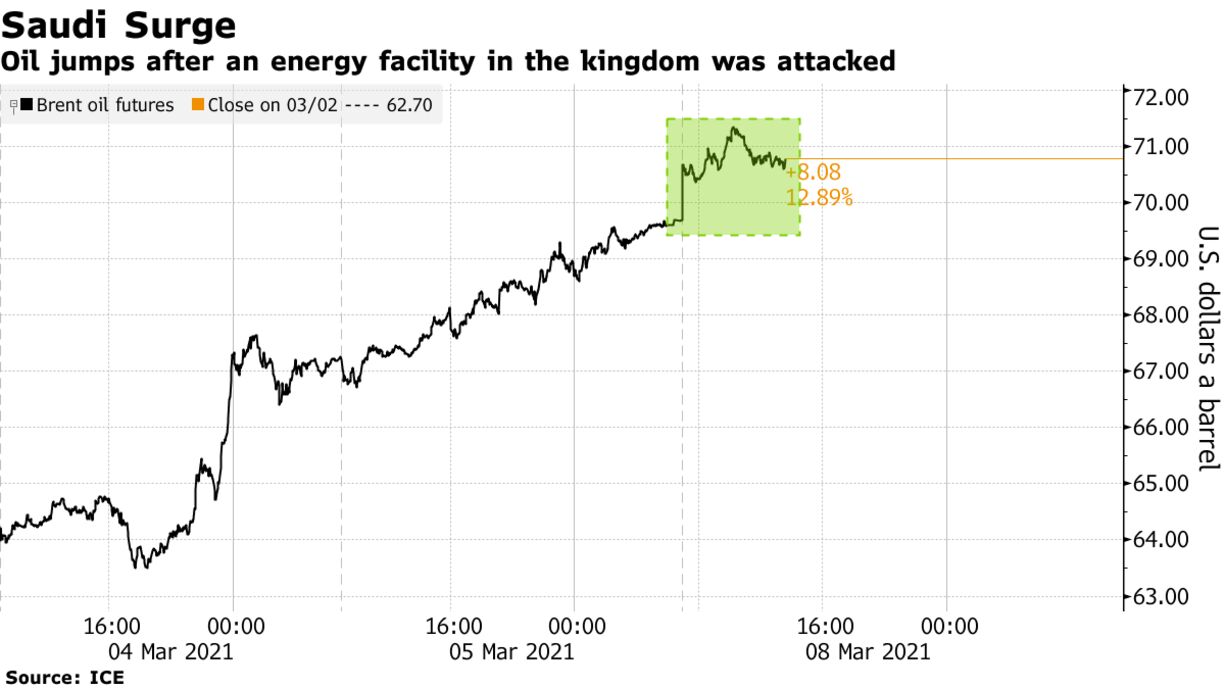

Brent oil surged above $71 a barrel after Saudi Arabia said the world’s largest crude terminal was attacked, although output appeared to be unaffected after the missiles and drones were intercepted. Futures in London jumped as much as 2.9% to the highest since January 2020 before easing slightly. The kingdom said a storage tank at Ras Tanura in the country’s Gulf coast was targeted on Sunday by a drone from the sea. The terminal is capable of exporting roughly 6.5 million barrels a day — nearly 7% of oil demand — and, as such, is one of the world’s most protected facilities.

The assault follows a recent escalation of hostilities in the Middle East region after Yemen’s Houthi rebels launched a series of attacks on Saudi Arabia. The new U.S. administration has also carried out airstrikes in Syria last month on sites it said were connected with Iran-backed groups.

Oil’s rally accelerated last week after Saudi Arabia and OPEC+ made a surprise pledge to keep output steady in April. The move prompted a raft of investment banks to raise their price forecasts, with Goldman Sachs Group Inc. estimating global benchmark Brent will top $80 a barrel in the third quarter.

The broader market is also being supported by bullish Chinese export data and the outlook for U.S. stimulus. President Joe Biden is on the cusp of his first legislative win with the House ready to pass his $1.9 trillion Covid-19 relief plan, the second-biggest economic stimulus in American history

| PRICES |

|---|

|

The rally north of $70 a barrel means a big headache for Asian refiners, which are warning that the rapid surge and spike in volatility will hurt demand and whittle away still-tight processing margins. Saudi Arabia has also boosted the official selling prices of its crude to buyers in the region for April.