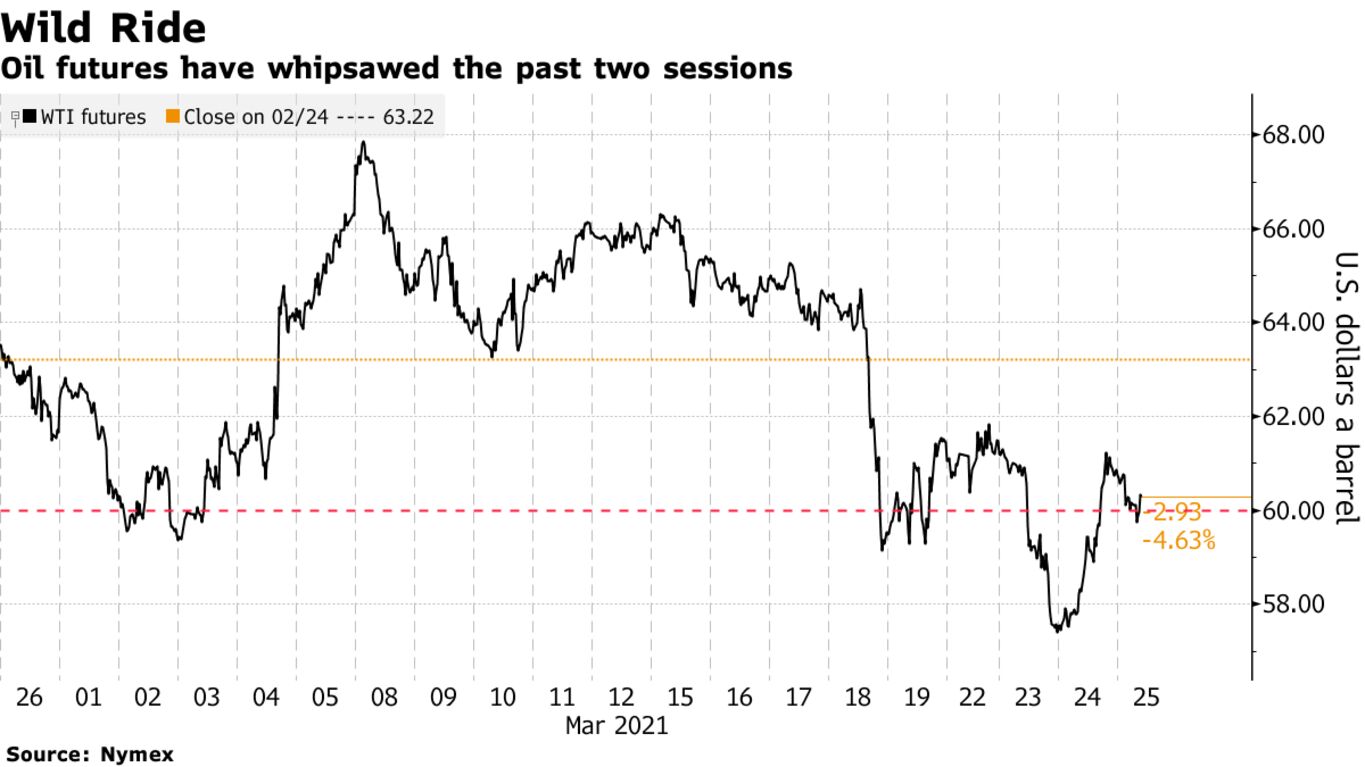

Oil retreated in Asia as traders monitored efforts to dislodge a massive ship blocking the Suez Canal, with market volatility rising after two wild days that saw prices whipsaw around 6% in both directions. Futures in New York slid 1.4% after prices surged back above $61 a barrel on Wednesday, clawing back almost all of the losses in the previous session. Work to re-float the container ship that’s stuck in the canal — a key trade route for crude flows — was expected to begin early Thursday in Egypt. The best chance of freeing the vessel may not come until Sunday or Monday.

Despite the recent sell-off, oil is still up more than 20% this year and there is confidence in the longer-term outlook for demand as coronavirus vaccinations accelerate worldwide while OPEC+ output cuts tighten supply. The alliance is scheduled to meet next week to decide production policy for May in a gathering that will be keenly watched by the market.

“The rebound was overdone,” said Michael McCarthy, chief markets strategist at CMC Markets Asia Pacific. “If anything, Suez is only going to be a temporary shipping issue for oil. It doesn’t change the supply-demand equation and doesn’t change the long-term outlook in any way.”

| PRICES |

|---|

|