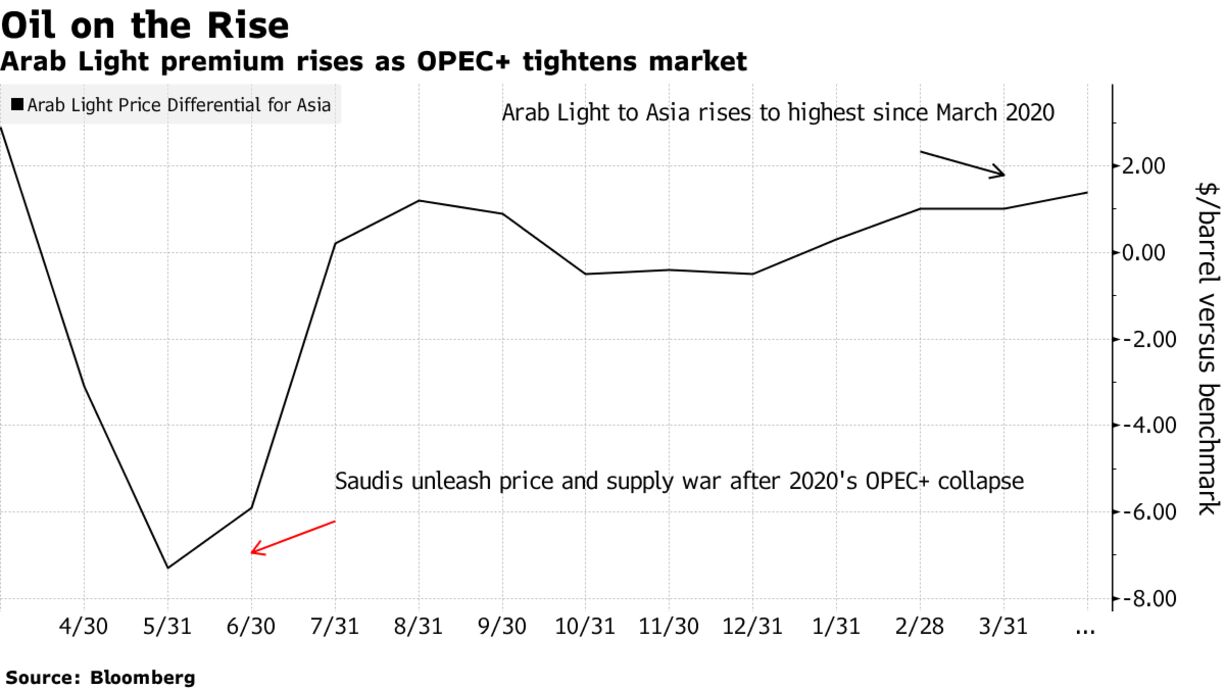

Saudi Arabia raised pricing for its crude for shipment to Asia and the U.S. next month after OPEC+ extended oil supply constraints, pointing to a tightening physical market. The world’s biggest crude exporter is boosting pricing for barrels sold eastwards to the highest levels since just before the Saudis unleashed a brief price and supply war a year ago. It suggests the Saudis see demand growth continuing even after Thursday’s shock OPEC+ decision to keep oil supply largely unchanged sent Brent crude higher.

“There’s definitely still more demand than last year” in China, the top crude importer, said Mike Muller, head of Asia at the world’s largest independent trader Vitol Group. There’s also a chance for further increases globally as the “demand growth outlook includes pent-up demand for summer travel,” he said Sunday during an online discussion hosted by consultancy Gulf Intelligence.

After maintaining prices to Asia at an eight-month high for the past two months, the premium for Arab Light crude rose to the highest since March 2020. Aramco raised prices for all other grades to Asia except for its Arab Heavy crude, which remained unchanged.

The Organization of Petroleum Exporting Countries and allies including Russia decided at a meeting March 4 that they would be sticking with output cuts that have buoyed the market so far this year. The Saudi pledge to extend a unilateral 1 million barrel-a-day cut through at least April also helped consolidate gains.

Saudis Cautious

The world’s biggest oil exporter had intended to boost production next month by adding back the 1 million barrels a day of oil that it unilaterally slashed for February and March. Instead, the kingdom took the path of greater caution, not risking an erosion in price gains if demand in virus-hobbled economies eases.