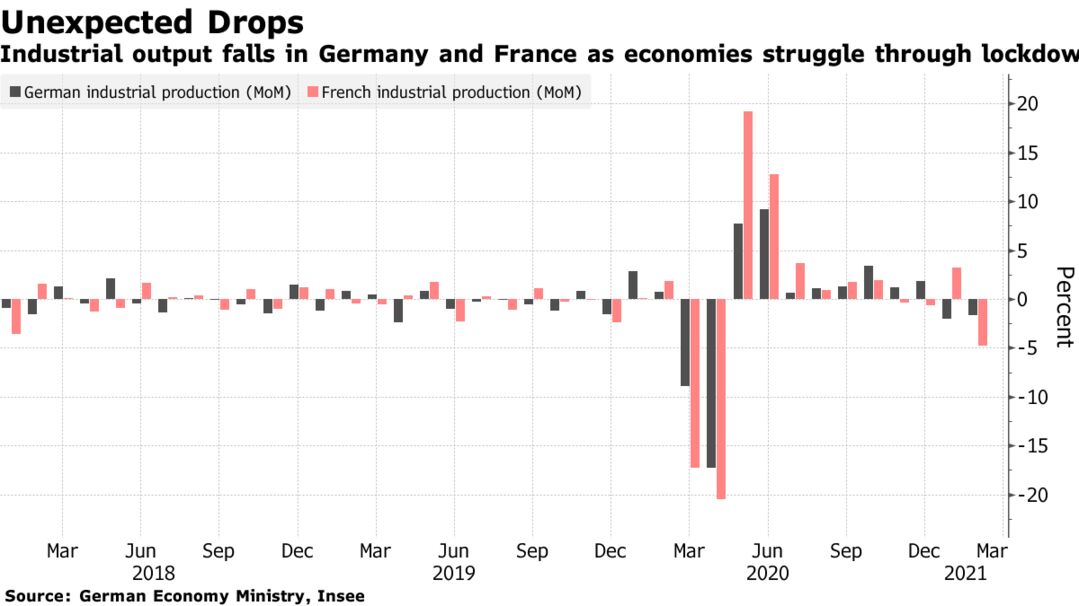

Germany and France, the euro area’s two largest economies, both saw unexpected declines in industrial production in February, suggesting that coronavirus restrictions are increasingly harming parts of the economy that have proved resilient so far. German output dropped 1.6% from the previous month, surprising all but three economists in a Bloomberg survey. Production in France slumped 4.7% and stagnated in Spain.

Euro-area manufacturing has held up relatively well in recent months as it benefits from economic recoveries in China and elsewhere. A separate release showed German exports rose 0.9% in February.

At home, persistently high coronavirus infections have kept large parts of the service sector shut, probably resulting in contractions in output in the first quarter.

France’s drop in industrial production — the steepest in ten months — was driven by a 11.4% decline in the automotive sector. In Germany, investment goods took a particular hit.

Still, the German economy ministry expressed some optimism that growth momentum will pick up in the months ahead.

“The improvement in business confidence and positive trend in orders signal a positive outlook in industry,” it said. “Nevertheless, the future course of the pandemic poses uncertainties.”

What Bloomberg Economics Says…

“The surprise drop in German production casts doubt on the narrative that booming global manufacturing is a big source of support for activity. Order books continue to fill up and survey data show businesses are as optimistic as they have ever been about the outlook. Friday’s data suggest that’s not translating into higher output — yet.”

-Jamie Rush. For the full note click here

Chancellor Angela Merkel has signaled she’d be in favor of another short, sharp shutdown lasting two to three weeks to contain the pandemic. With some regional leaders reluctant to even fully implement the current measures, she has threatened to transfer powers to the federal level to impose additional curbs.

Earlier this week, France cut its economic growth forecast for this year to 5% from 6% as a stricter one-month lockdown hurts activity. The government is banking on a strong rebound from the summer to make up for a weak start to the year.