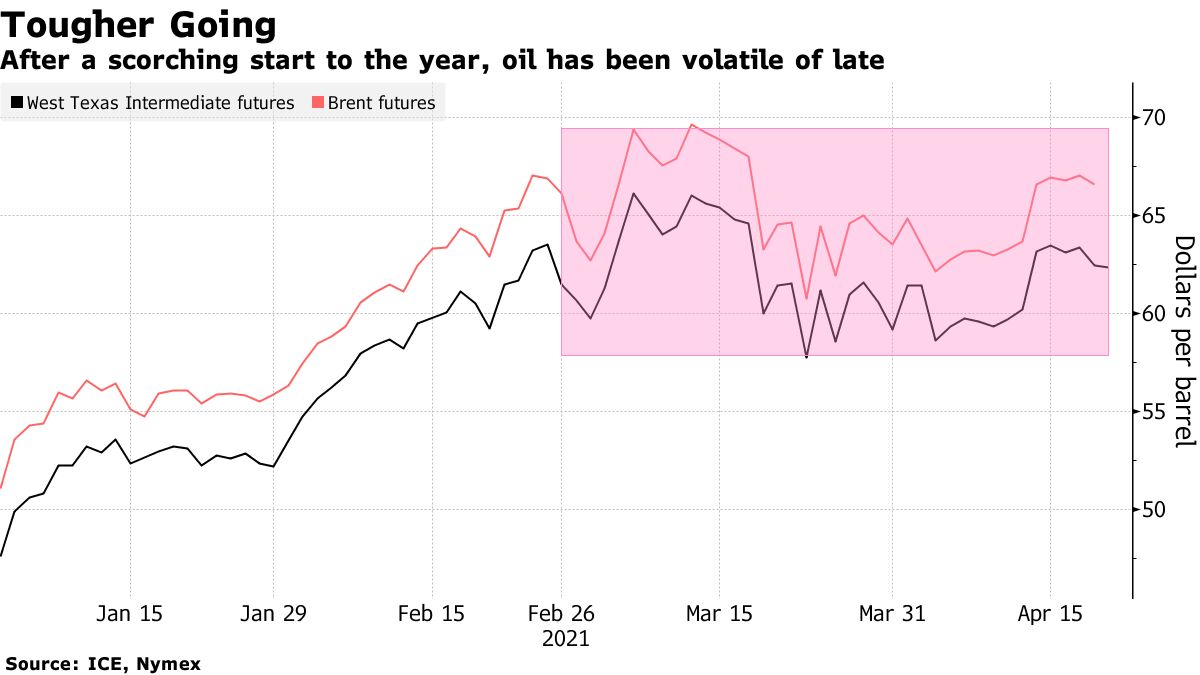

Oil fell amid concern that a resurgent virus will hurt demand in some economies, while industry data showed a slight build in U.S. inventories. West Texas Intermediate retreated 1.1%, extending Tuesday’s decline. The renewed spread of Covid-19 in countries such as India is casting a pall over the global economic rebound, even as signs of an improvement in energy demand elsewhere continue to mount. Prices also responded to a stronger dollar, which reduces the appeal of commodities priced in the currency.

Oil’s value has risen by more than a quarter this year as vaccines are rolled out, paving the way for a relaxation of lockdowns, greater economic activity and increased mobility. Against that backdrop, the Organization of Petroleum Exporting Countries and its allies plan to start easing deep supply cuts from May. But the dramatic flare-up in cases in India is undermining the narrative that there’ll be an uninterrupted rebound in global consumption. “A stronger dollar and concern that rising Covid-19 cases will slow down the oil demand recovery” are underpinning price moves on Wednesday, said Giovanni Staunovo, a commodity analyst at UBS Group AG.

| PRICES |

|---|

|

The American Petroleum Institute reported a 436,000-barrel weekly gain in crude stockpiles, while gasoline supplies fell by more than 1.6 million barrels, according to people familiar with the data. If confirmed by government figures later Wednesday, it would be the first build in crude inventories in four weeks.

In India, soaring virus cases have forced the financial and political capitals to impose curbs on movement, with New Delhi mandating a six-day lockdown that started Tuesday. With the situation in South Asia deteriorating, the World Health Organization warned cases are rising in all regions except Europe.