Oil pared an earlier gain as investors assessed a patchwork recovery in energy demand, with signs of a rebound from the pandemic in some countries mixed with setbacks in parts of Asia where the virus is still rampant. West Texas Intermediate eased its earlier gain to trade near $61 a barrel in New York on Friday. So far this month, crude futures have swung between weekly gains and losses torn between divergent demand indicators. Among the latest were robust manufacturing figures in Europe, though India continues to set a record number of daily cases and diesel and gasoline consumption may fall by 20% there this month.

Oil remains more than 25% higher in 2021, aided by the roll-out of Covid-19 vaccines and vigilant supply management from the Organization of Petroleum Exporting Countries and its allies. But the bulk of crude’s advance came in the first two months of the year, and prices have struggled since. OPEC+ is set to start easing deep supply curbs from May, and the group is expected to hold a full ministerial meeting next week to assess the global state of play.

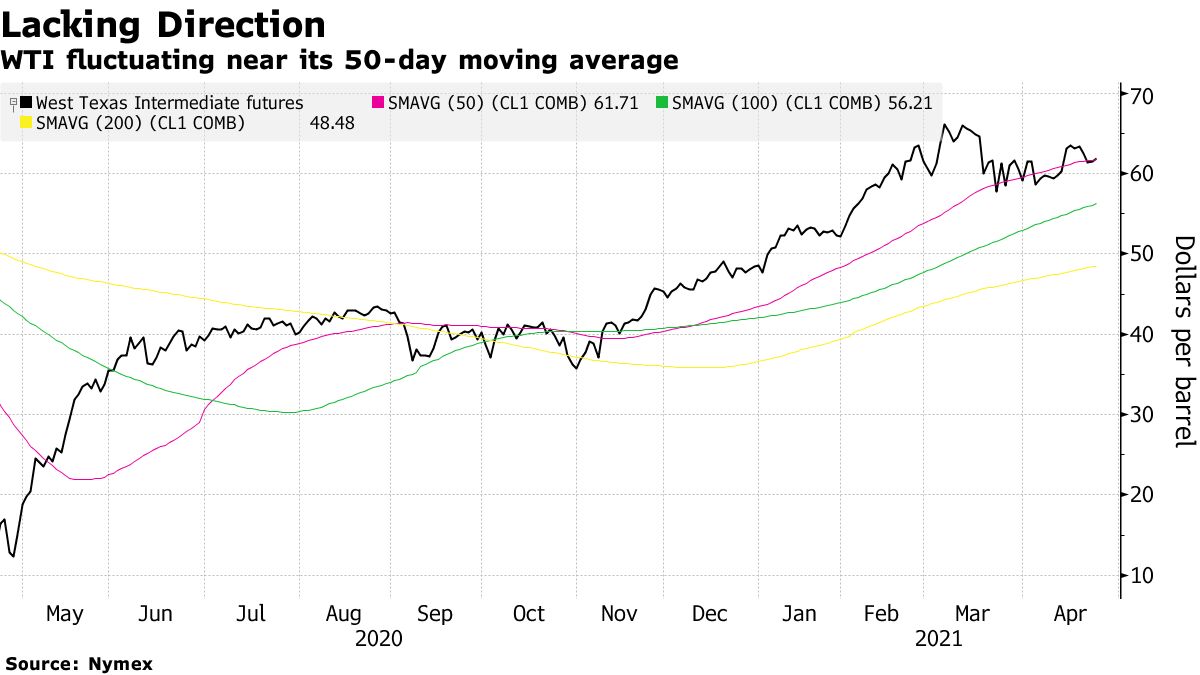

| PRICES |

|---|

|

As India’s outbreak worsens, the nation’s combined consumption of diesel and gasoline is poised to plunge by as much as 20% in April from a month earlier due to renewed restrictions, according to officials from refiners and fuel retailers. Meanwhile, Japan is facing an increase in cases and a state of emergency will be declared from Sunday to May 11 in cities including Tokyo.

Elsewhere in the region, there’s concern about the potential for a rise in cases and curbs around Ramadan, when millions of people head home to regional towns from urban centers. Southeast Asia’s biggest predominantly Muslim nations, Indonesia and Malaysia, are tightening movement restrictions to avert a possible surge. The month-long fasting period ends in mid-May.