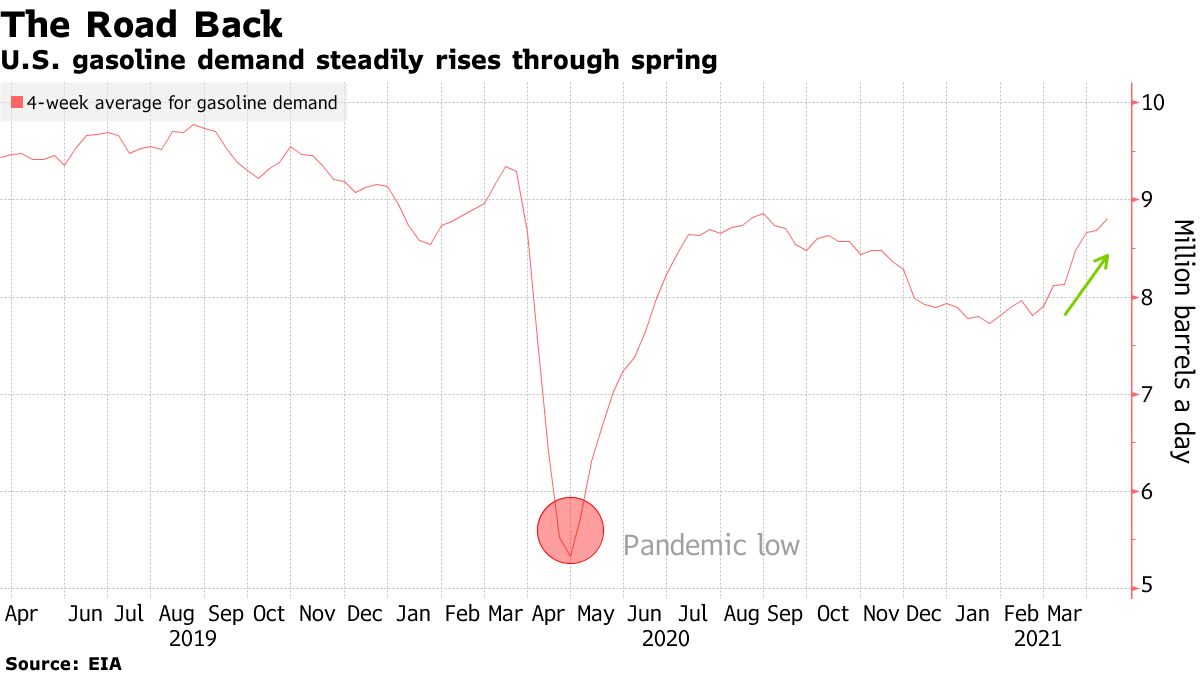

The U.S. economy is emerging from a year of lockdowns in a big way and that’s showing up in the oil market. A rolling average of U.S. gasoline demand rose to the highest since August, according to the latest data from the Energy Information Administration. The nation’s refineries are processing the most crude crude oil in over a year just after the pandemic started as they make more fuel for the upcoming summer travel surge. At the same time, crude supplies fell by the most in two months, bringing nationwide stockpiles to the lowest since late February.

The data underpin the recovery in the oil market a year after the pandemic spurred a historic demand crash. Gasoline demand has been leading the comeback, with more gains in diesel and jet fuel needed to provide sure footing for markets after the pandemic slump. West Texas Intermediate crude futures surged more than 5% Wednesday and broke out the narrow trading range they had been stuck in since mid-March.

The oil rally comes during a period of quicker economic expansion, as cited in a speech Wednesday by Federal Reserve Chair Jerome Powell. Gasoline prices have averaged about $2.86 as gallon this spring amid predictions they should hit $3 a gallon this year for the first time since 2014.

Careful supply management by refiners has helped maintain balance. Only 300,000 barrels of gasoline were added to storage last week, even with more production. Stockpiles are about 28 million barrels below where they were a year ago. “These numbers are quite constructive for gasoline,” said Houston oil analyst Andy Lipow. “We are headed to what looks like a decent summer driving season with Americans having been pent up with their desire to get out on the road.”

To be certain, the market still has a long way to go for a full recovery, gasoline demand is