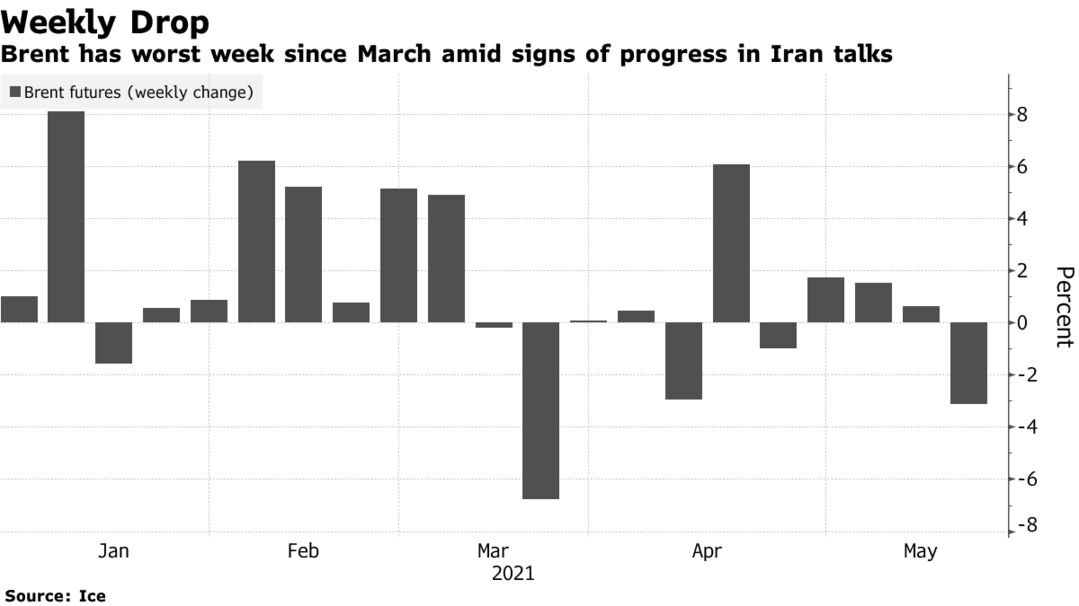

Oil benchmarks suffered their worst week in at least a month as the market contends with a potential deal that could lift U.S. sanctions against Iranian crude. WTI futures in New York rose the most since mid-April on Friday, tracking a broader market rally that buoyed prices during most of the trading day. Nonetheless, crude benchmarks couldn’t shake off the specter of millions of barrels a day of Iranian crude returning to the market, with Brent futures in London posting the largest weekly decline since March. President Hassan Rouhani this week said world powers have accepted that major sanctions will be lifted as part of any nuclear deal.

“There’s concern about the additional slug of supply potentially coming from Iran,” said John Kilduff, a partner at Again Capital LLC. “As the market was getting back on its feet, the prospect of more Iranian supply has been a momentum killer.”

Some of the most optimistic analysts estimate Iran could return to pre-sanctions production of almost 4 million barrels a day in as little as three months. Iranian oil output has been rising this year and was about 2.4 million barrels a day last month, according to estimates compiled by Bloomberg.

“The most pressing question will be how much an early Iranian ramp-up could hurt third-quarter balances,” Hsueh wrote. “The schedule of the ramp-up will be principally a question of politics and negotiation,” as Iran’s supply “could be brought into the market before an actual increase in production.”

Oil this week was also swept up in a broader selloff in commodities and equities markets following concerns about inflation, speculation that the U.S. Federal Reserve will ease stimulus and China’s warning on measures to cool price spikes. The surge in the coronavirus continues to haunt some major consumers, with India’s largest refiner canceling a tender to buy Middle Eastern crude.

The streak of losses this week tested the borders of oil’s current trading range, with the benchmarks finding technical support after dipping to their lowest since April. Brent has been trading within a roughly $5 band over the last month, pulling back from $70 a barrel but prompting a round of buying the closer it got to $65.

| PRICES | |

|---|---|

|

With traders gearing up for even more supply, Brent’s nearest timespread had approached a bearish contango structure in an indication market tightness is easing.

Prior to the implementation of sanctions, Iran was producing about 3.8 million barrels a day of crude. Only Iraq and Saudi Arabia’s output exceeds that amount within the Organization of Petroleum Exporting Countries. Still, Citigroup Inc. estimates overall global demand is strong enough to absorb any additional supply, including from Iran and that prices will continue to climb. Meanwhile, the prompt spread for Nymex gasoline futures moved into a marked contango on Friday, reflecting expectations that fuel markets may be oversupplied.

“The gasoline spread threatening to switch to contango implies the gasoline market is oversupplied going into Memorial Day weekend, and that’s a negative price development,” said Bob Yawger, head of the futures division at Mizuho Securities. “The inflation situation has also started to spook some people, with prices at the pump getting a little lofty.”