China’s economic growth faces headwinds this year due to weaker-than-expected investment spending in the country’s vast manufacturing sector, driven by Beijing’s efforts to rein in pollution and by a profit squeeze at labor-intensive manufacturers, according to Citigroup Inc. economists.

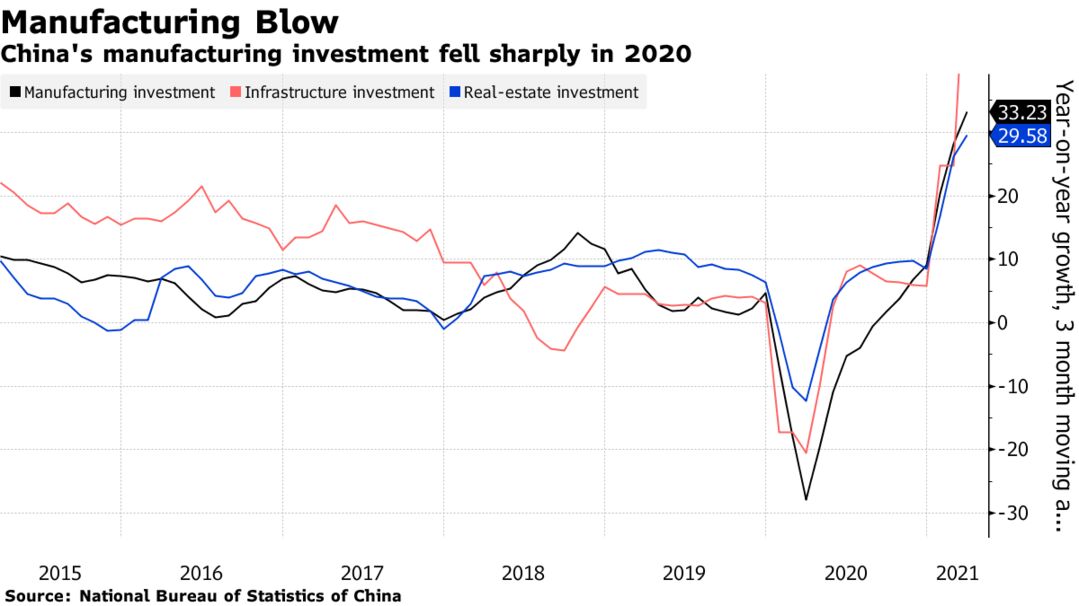

Spending by manufacturers has been the slowest component of Chinese investment to recover from the pandemic, with outlays in the first quarter still below 2019 levels. Manufacturers’ profitability, the main source of their investment funds, plunged last year, and many businesses are seeing margins squeezed by higher commodity prices and a resumption of social-security contributions that were suspended during the pandemic, Citi economists said in a report.

Manufacturing investment “may be at risk of coming out lower than our previous expectation,” which would have a “sizable impact” on a previous forecast that China’s GDP will grow 8.8% this year, the economists said. While a strong real estate sector has driven a surge in profitability in sectors such as steel and cement, greater government focus on cutting air pollution and slowing growth in carbon emissions will limit their capacity expansion this year, they said.