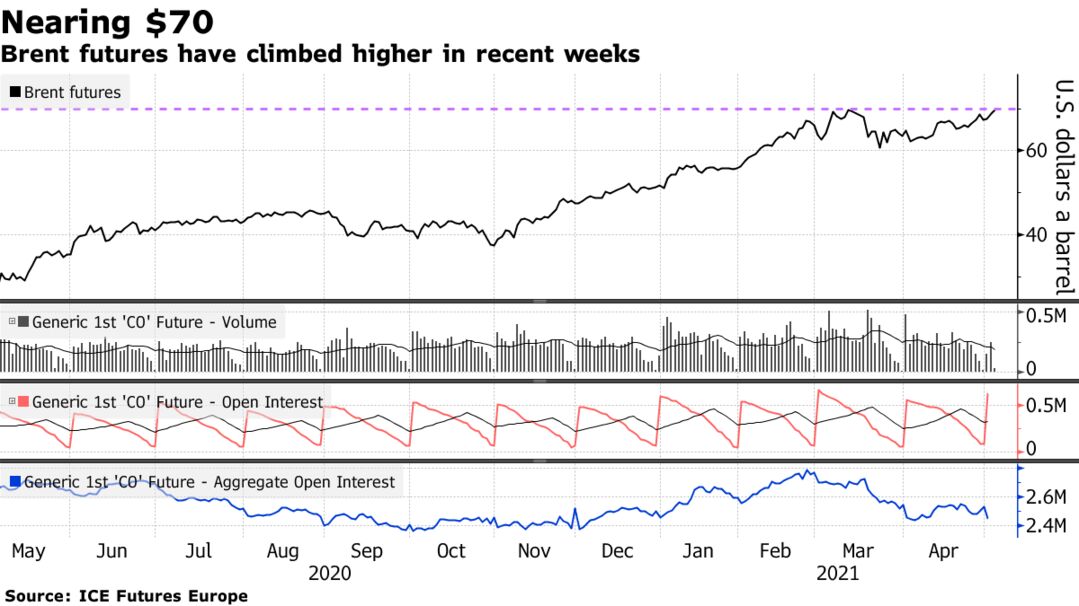

Oil extended a rally after U.S. stockpiles fell and reopening drives in the U.S. and Europe showed signs of boosting demand. Brent neared $70 a barrel and West Texas Intermediate climbed for a third day. Gasoline futures surged to the highest since July 2018. The American Petroleum Institute reported crude supplies fell by 7.69 million barrels last week, according to people familiar with the data. If confirmed by government figures on Wednesday, that would be the largest drop since late January. The API report also showed lower gasoline and distillate inventories.

Aiding the outlook for improved oil consumption, the U.S. is setting a new target of 70% of U.S. adults receiving at least one Covid-19 vaccine shot by July 4, while British Prime Minister Boris Johnson said his country’s lockdown rules will be scrapped in seven weeks. That’s offsetting concerns about weaker demand in parts of virus-hit Asia, including key importer India.

| PRICES: |

|---|

|

Brent’s pricing patterns reflect the overall bullishness, with near-term contracts above those further out. The December 2021 contract was as much as $5 more costly than the same month in 2022, a market structure that indicates tightness and suggests traders are betting on a further rally.