A Covid outbreak that has partially shut one of the world’s busiest container ports is heightening concerns that the rapid spread of the delta variant will lead to a repeat of last year’s shipping nightmares.

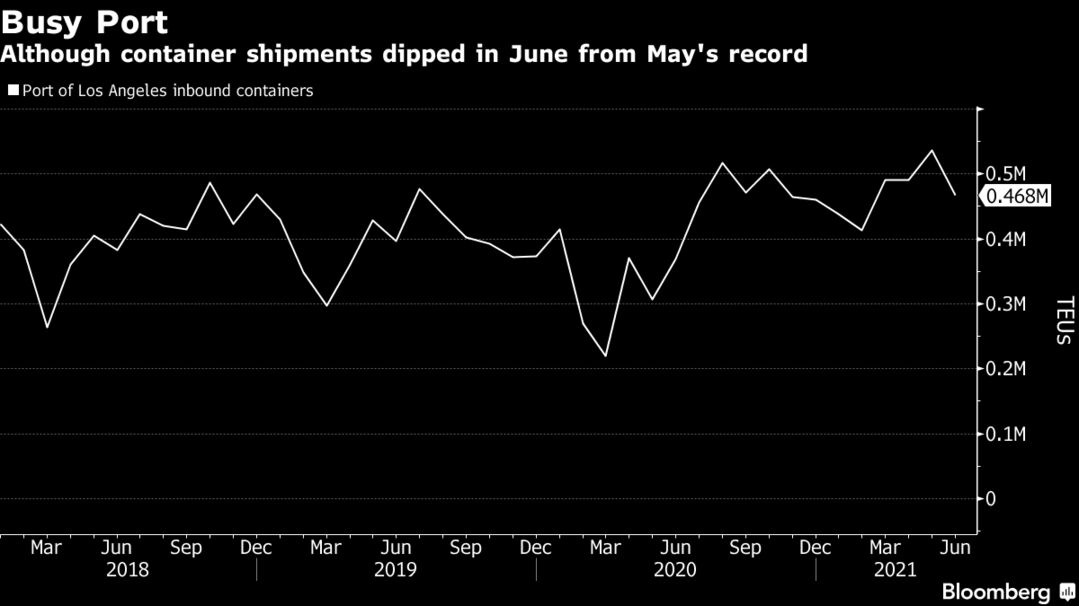

The Port of Los Angeles, which saw its volumes dip because of a June Covid outbreak at the Yantian port in China, is bracing for another potential decline because of the latest shutdown at the Ningbo-Zhoushan port in China, a spokesman said. Anton Posner, chief executive officer of supply-chain management company Mercury Resources, said that many companies chartering ships are already adding Covid contract clauses as insurance so they won’t have to pay for stranded ships.

It seemed as if things were just starting to calm down, “and we’re now into delta delays,” Emmanouil Xidias, partner at Ifchor North America LLC, said in a phone interview. “You’re going to have a secondary hit.”The shutdown at Ningbo-Zhoushan is raising fears that ports around the world will soon face the same kind of outbreaks and Covid restrictions that slowed the flows of everything from perishable food to electronics last year as the pandemic took hold. Infections are threatening to spread at docks just as the world’s shipping system is already struggling to handle unprecedented demand with economies reopening and manufacturing picking up.

Ningbo-Zhoushan Port said in a statement late Thursday that all other terminals aside from Meishan have been operating normally. The port is actively negotiating with shipping companies, directing them to other terminals, and releasing information on a real-time data platform, it said.

To minimize the impact, it’s also adjusting the operating time of other terminals to make sure clients can clear their shipments. A spokesman for the port said there were no further updates when contacted Friday.

About 28 container ships were anchored outside the Ningbo-Zhoushan port area as of Aug. 12 and were waiting for berth space, according to a note from supply-chain intelligence firm project44. Port calls to Ningbo have plummeted to less than 60 ships this week, down 70% from about 200 container vessels last week, the data showed.

Already, Peru is experiencing delays in some crops trade with China, one of its largest trading partners.

“That whole circuit is disrupted when ports are closed due to the pandemic,” said Gabriel Amaro, head of Peru’s agriculture industry group Agap. “What happened at the beginning of the pandemic is repeating.”

The China port shutdown may fuel further increases in freight rates, which have been rising as the shipping industry grapples with bottlenecks during the virus pandemic.

Freight Rates

Diverting ships to other terminals “creates port congestion, which we’ve all been dealing with during Covid,” John Wobensmith, chief executive officer of Genco Shipping & Trading, said in an interview with Bloomberg TV. “And I do see that increasing, which will have the effect of pushing freight rates higher, whether it’s in dry bulks and or the container side.”

The benchmark cost of shipping a container from Shanghai to Los Angeles has tripled over the past year. The Baltic Dry Index of bulk shipping prices has risen more than 10% since mid July.

Some ships that docked at the Meishan terminal before the closure are suspending cargo operations until the terminal re-opens, according to a notice sent by shipping line CMA CGM SA to shippers.