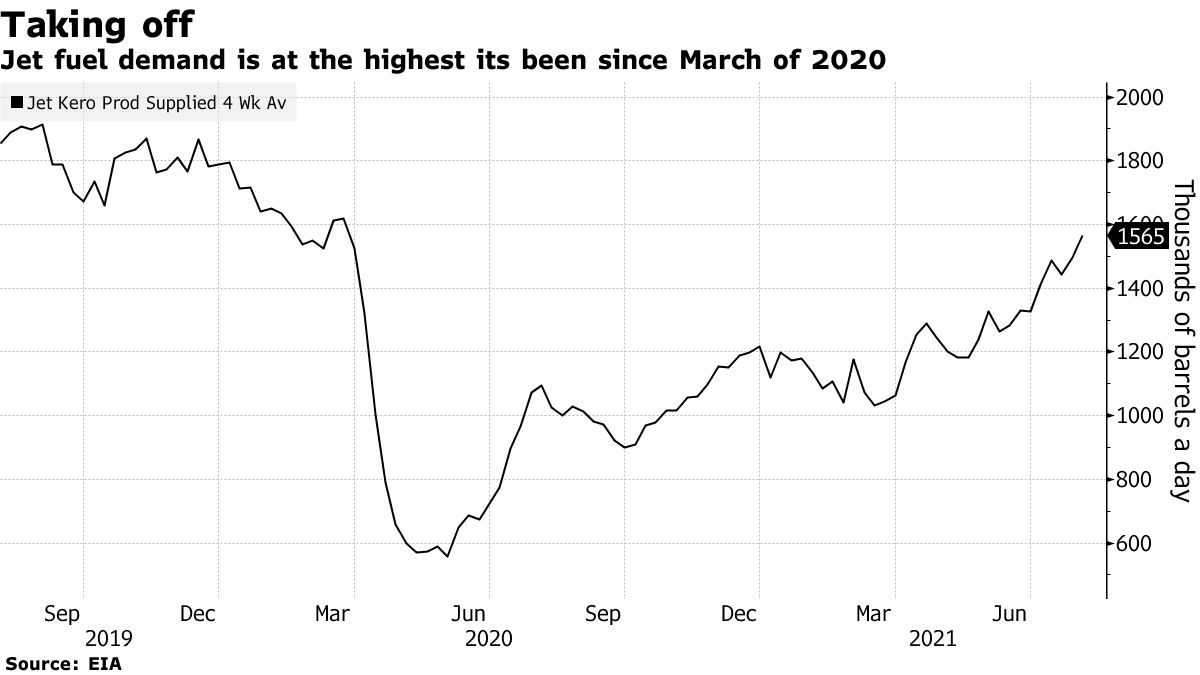

Jet fuel demand is finally taking off as American travelers return to the skies, but concerns over the Delta variant of Covid-19 may further delay full recovery.

U.S. consumption of the fuel on a four-week average basis surged to 1.57 million barrels a day, the highest since the pandemic shut the economy down last March, according to a government report Wednesday. That’s still 16% lower than the same time two years ago.A slow return of air travel has been the biggest drag on the oil market. Recent indicators have pointed to more foot traffic at airports and increased flight numbers.

The count of people through U.S. Transportation Security Administration checkpoints has been at its highest in more than a year, with Sunday’s foot traffic matching early 2020 levels.

To return to seasonal norms, though, airlines will need to buy enough additional fuel to fill hundreds of more jets. International flights like those from New York to London and from the West Coast to Asia still need to pick up, as does business travel. Jet fuel suppliers are likely to move slowly in response.

Jet fuel stocks have swelled because of demand on the ground. Consumption of gasoline hit a one-week record last month, and fuel makers ramped up production to chase summer profit.

“There is a backlog of global jet fuel. There has to be, because you can’t produce gasoline without the other products,” said Trisha Curtis, Chief Executive Officer at PetroNerds.