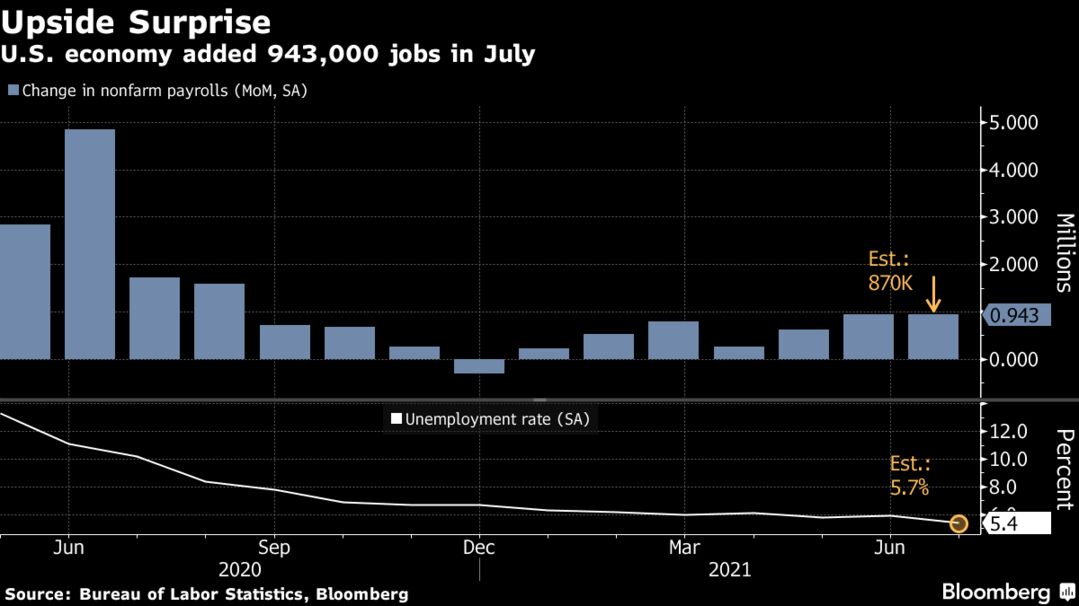

The U.S. labor market charged ahead in July with the biggest increase in employment in nearly a year, highlighting optimism about the economy’s prospects even as coronavirus concerns resurface. Payrolls climbed by 943,000 last month after upwardly revised increases the prior two months, a Labor Department report showed Friday. The unemployment rate dropped to a pandemic low of 5.4%, while earnings and hours worked remained elevated.

The figures mark a big step toward the Federal Reserve’s goal of “substantial” further progress in the job market that will add fuel to the debate on how quickly officials should begin dialing back their bond buying.

At the same time, payrolls remain 5.7 million short of pre-pandemic levels, and a pickup in Covid-19 cases stemming from the delta variant poses a risk to the pace of job growth.

“This is a very strong report across all metrics,” Jeffrey Rosenberg, a senior portfolio manager at BlackRock Inc., said on Bloomberg Television. “There’s very little that you could point to here that’s disappointing.”

The median estimate in a Bloomberg survey of economists called for a 870,000 gain in payrolls. The dollar and 10-year Treasury yields advanced as traders bet a strengthening labor market will lead Fed officials to begin pulling back their bond buying program. Stocks were mixed.

Officials including Chair Jerome Powell and Governor Lael Brainard have indicated the labor-market recovery had some way to go before the central bank could begin tapering asset purchases.

Fed Governor Christopher Waller said this week that if the next two monthly employment reports show continued gains, he could back such a move.

“While there were some indications that labor constraints continued to ease, the rise in the delta variant clouds the outlook,” Wells Fargo & Co. economists Sarah House and Shannon Seery, said in a note. “Fed officials will likely be pleased with July’s progress, but we ultimately think they will want to see further ground recovered.”