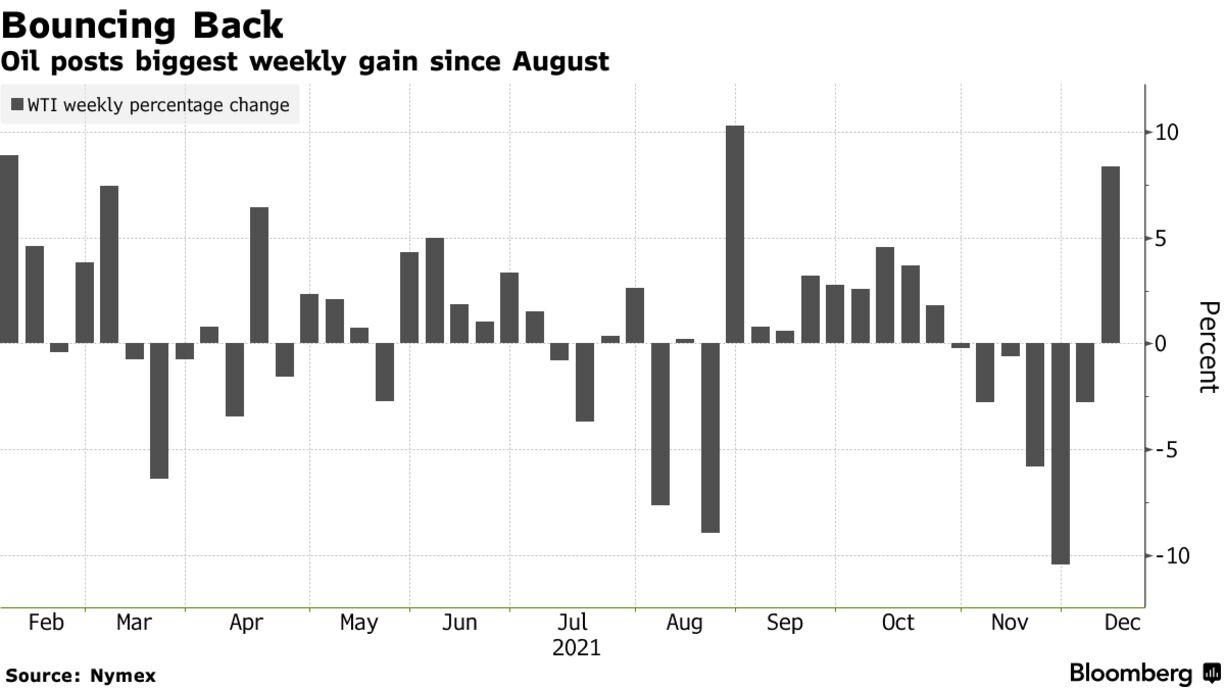

Oil set its biggest weekly gain in more than three months as the worst fears over the new virus strain have receded.

West Texas Intermediate futures climbed 8.2% this week. Fuel consumption so far has escaped any major blows from the omicron variant. Yet confidence is limited. Rallies are still punctuated by selloffs such as that on Thursday after rising infection rates prompted some governments to tighten travel restrictions.

“Crude prices are having a good week as omicron jitters have eased and as the 2022 growth outlook for the US economy remains mostly undeterred,” said Ed Moya, senior market analyst at Oanda Corp.

Oil has seen a remarkable turnaround after tumbling into a bear market on Nov. 30, following a multiweek plunge. But concerns persist over the omicron variant, which one study indicates is 4.2 times more transmissible than the delta strain in its early stages.

Some signs of weakness are emerging. Traders are facing the prospect of a weakening physical market for crude in Asia, despite Saudi Arabia’s move to increase oil prices for January. The prompt timespread for global benchmark Brent has also narrowed this week, pointing bearish sentiments.

| PRICES |

|---|

|

Many parts of the eastern U.S., including New Jersey and Connecticut, are seeing a rise in hospitalizations. The City of London may be on the verge of becoming a ghost town again after firms started telling thousands of staff to work from home in response to the latest U.K. government guidance.

In the U.S., consumer prices rose last month at the fastest annual pace in nearly 40 years, magnifying persistent inflation and with consumers facing the biggest jump in energy bills in more than a decade. The inflation headline numbers continue to add pressure for the Federal Reserve to tighten monetary policy