It’s official: Chinese equities are once again in vogue, after months of regulatory crackdowns, deleveraging and stringent virus curbs wiped trillions of dollars off benchmark gauges.

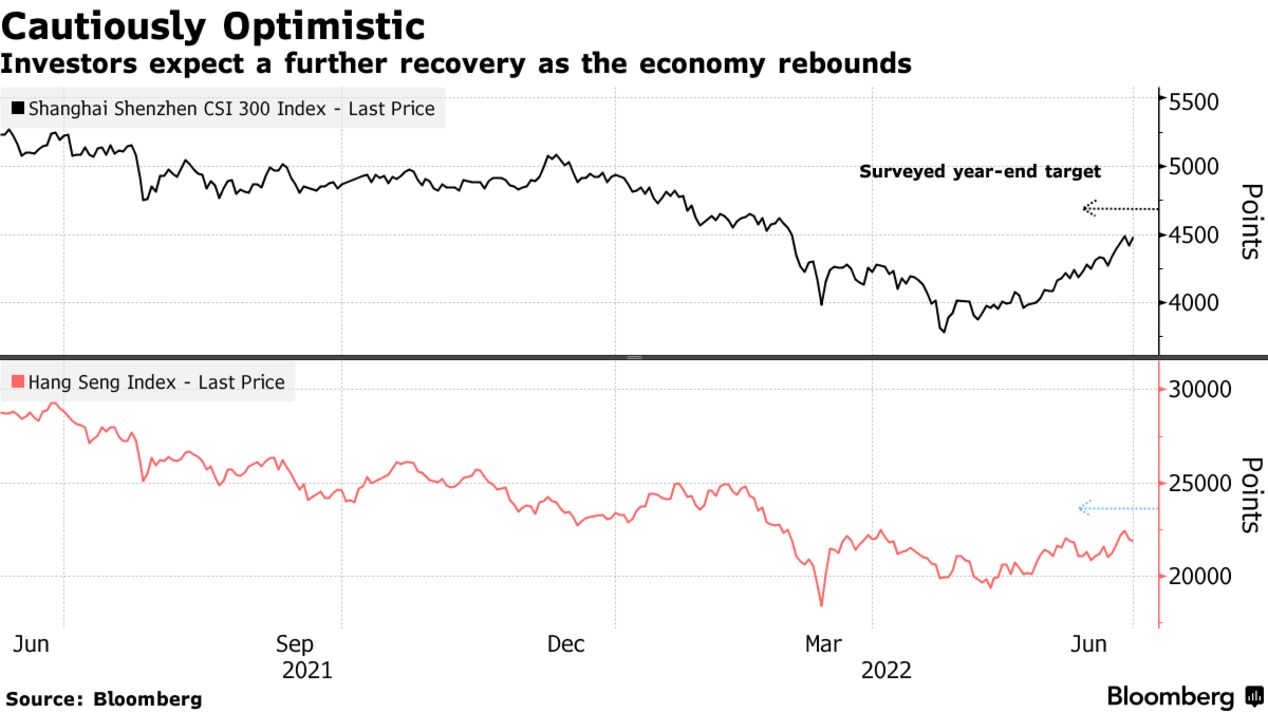

A Bloomberg survey of 19 fund managers and analysts predicts that benchmark stock indexes in China and Hong Kong will post gains of at least 4% by year-end to outperform their global peers. About 70% of those polled plan to maintain or boost holdings of shares in the mainland and the financial hub in the next three months.

The optimism marks a stunning reversal from March when investors raced to trim exposure to Chinese assets on fears that the nation’s Covid lockdowns and the war in Ukraine would damp economic growth. A recent easing of virus restrictions has propelled the CSI 300 Index to the brink of a bull market, and a loose policy stance has helped local equities defy the recent selloff in global stocks.

“Covid restrictions will gradually ease and under the backdrop of stability as the overarching priority, the government may provide a relatively loose monetary environment in the second half, with the liquidity benefiting stocks,” said Fang Rui, managing director at Shanghai WuSheng Investment Management Partnership. “We’re quite optimistic on valuation recovery also lifting the indexes higher.”

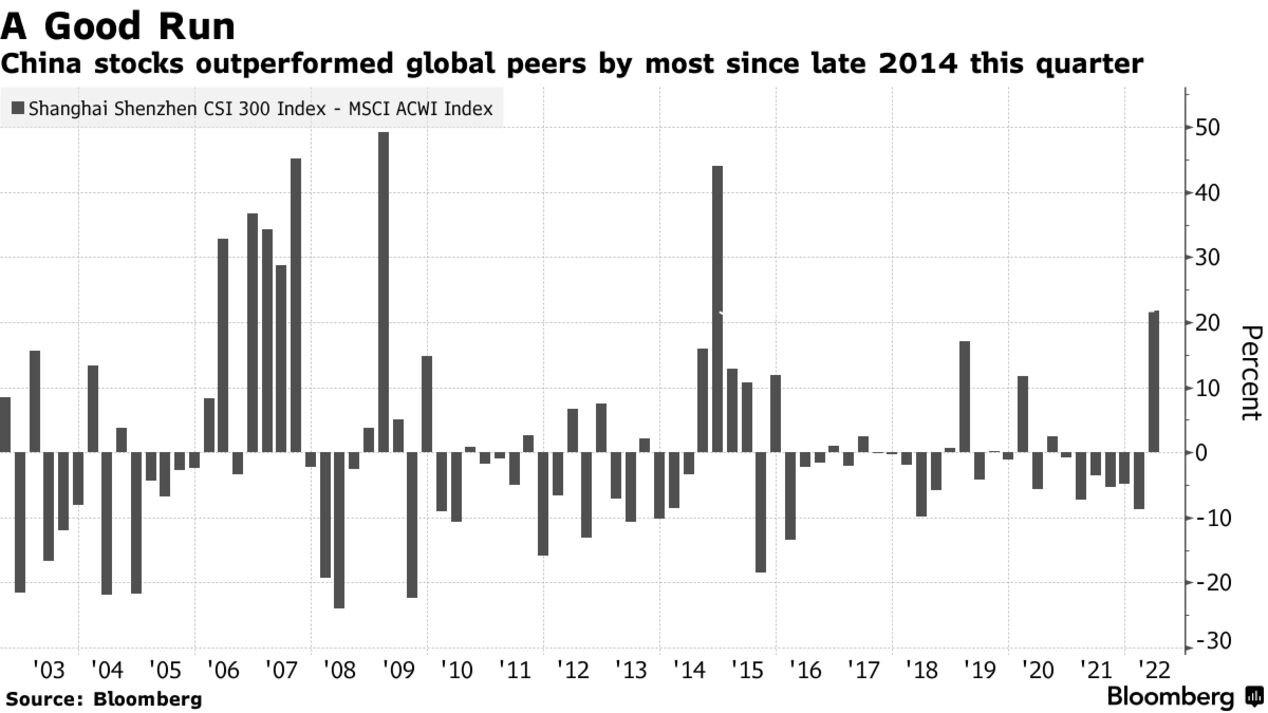

The optimism is reflected in the recent bounce in Chinese shares, with the CSI 300 gauge rallying about 19% from an April low after Beijing lifted lockdowns in major cities — a performance that’s among the best in global markets. The authorities cut quarantine times for inbound travelers by half this week and policy makers have also signaled that regulatory crackdowns on tech giants will ease as they pivot toward supporting growth.

China Stocks Get Reopening Boost After Some Travel Rules Eased

That’s fueled a rush of buying as global funds purchased a net 73 billion yuan ($10.9 billion) of onshore stocks via trading links in June, the largest monthly inflow since December. Capital flows into China are set to get a further boost when dozens of mainland listed ETFs are made available to overseas investors through the stock connect program starting July 4.