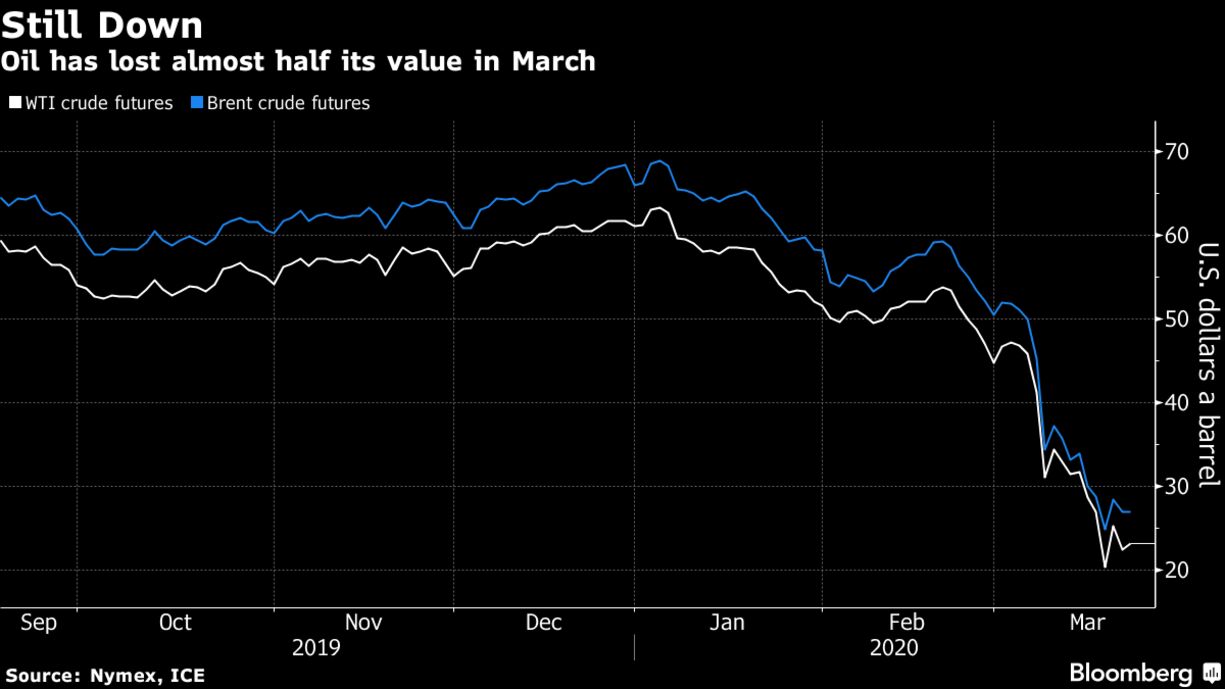

Oil clawed back some gains after plunging 29% last week as the U.S. signaled the possibility of a joint U.S.-Saudi Arabia alliance to stabilize prices. Futures in New York rose 3.2% Monday in a mixed day of trading. Prices initially bounced following a second wave of initiatives by the Federal Reserve to support a shuttered American economy. A rally in other risk assets such as equities was soured by a second failed effort by Congress to agree on a stimulus bill.

“Almost hitting the lower trading bounds in the 20s has given some support for WTI and Brent,” said Ryan Mckay, commodities strategist at TD Securities. “Generally, the stimulus is helping sentiment, even if it’s not helping demand. Investors may be hanging on to a sliver of hope that an OPEC-Texas relationship may transpire.

U.S. Energy Secretary Dan Brouillette said the possibility of a joint U.S.-Saudi oil alliance is one idea under consideration to stabilize prices after the worst crash in a generation. “As part of the public policy process, if you will, our interagency partners often get together and talk about a number of different items, but we’ve made no decision on this,” he said. “At some point we will engage in a diplomatic effort down the road. But no decisions have made on anything of that nature.”