Oil rose for a second day as the world’s top producers moved closer to a deal to curb output in an attempt to tackle the unparalleled impact of the coronavirus on demand. Futures in New York rose 5.9% as Russia said it’s ready to cut production by 1.6 million barrels a day. The OPEC+ meeting on Thursday will discuss curbing output by 10 million barrels a day, said Algeria’s energy minister, who holds OPEC’s rotating presidency. Decisions at the online gathering will form the basis of Friday’s discussions on further contributions from G-20 nations, with U.S. involvement seen as the key.

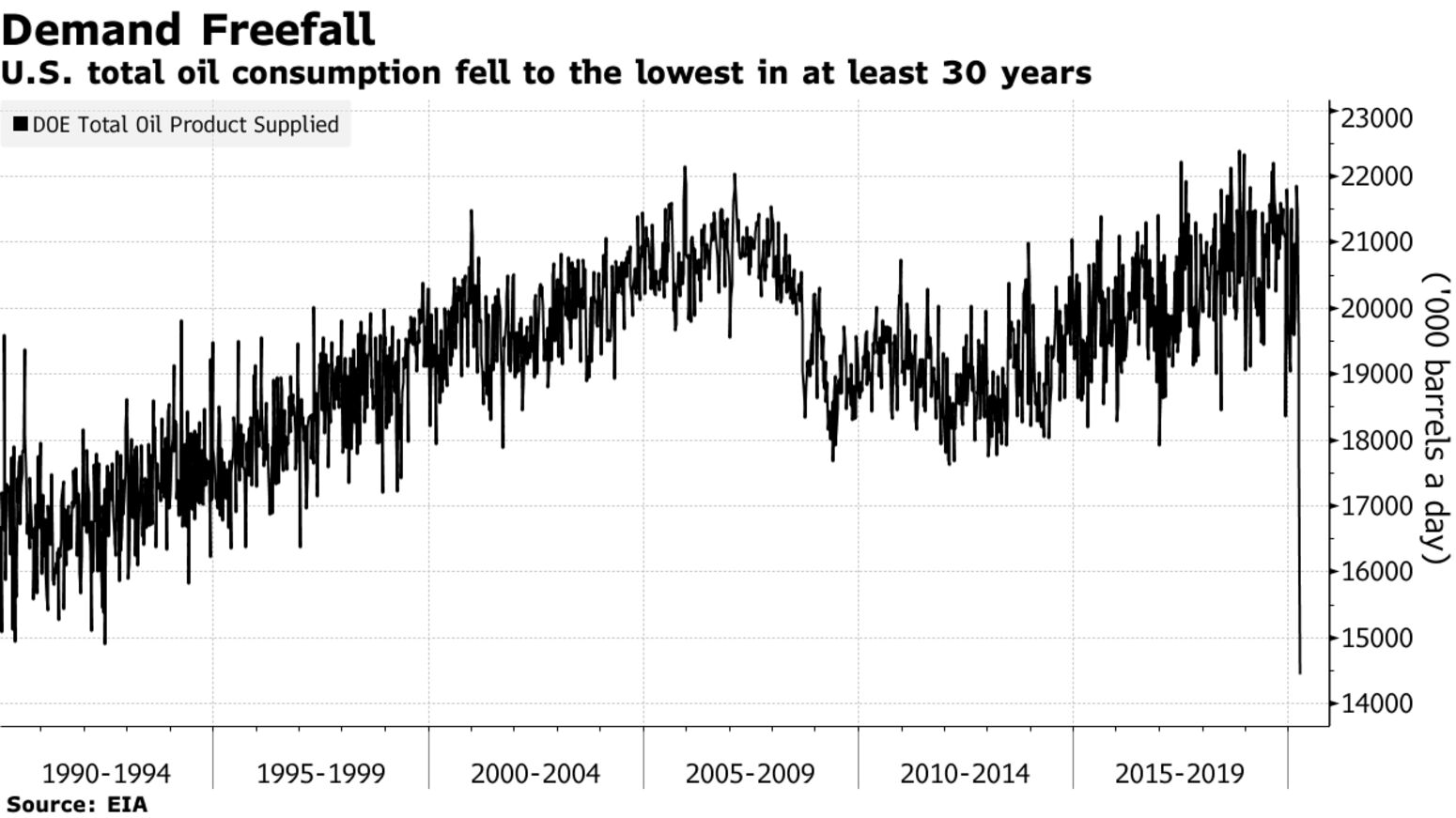

Major producers are scrambling for a deal as energy consumption has plummeted and hammered prices. Oil demand in India has collapsed by as much as 70% and some American refineries face closure as consumption fell to the lowest in at least three decades. Producers will need to agree on a deep and prolonged supply cut, or risk crude falling back again.

“Saudi Arabia and Russia want to see a broader collation of countries participating in this supply reduction, not just OPEC+, and in particular their eyes are on the U.S.,” said BNP Paribas oil strategist Harry Tchilinguirian. “At best, a successful outcome to the meetings is likely to provide a floor over the next quarter or so.”

See also: Global Oil Deal in Sight After Russia Signals Readiness to Cut

All but one of 26 analysts, traders and refiners surveyed by Bloomberg forecast that a production cut will be agreed this week, with the average of their estimates at 8.5 million barrels a day. While that’s a vast decrease, it would pale in comparison to the demand loss that some gauge is as much as 35 million barrels a day.