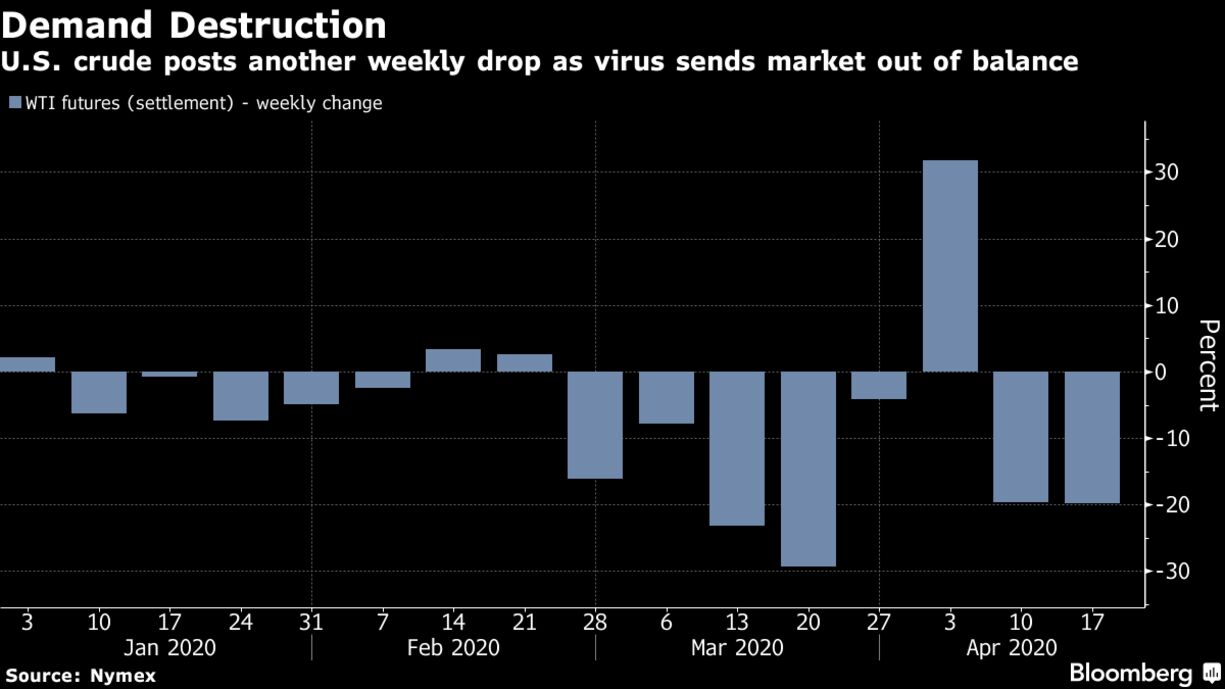

Oil closed the week at the lowest since 2002 as an historic OPEC+ production cut failed to counter a wave of gloomy demand forecasts and concerns that traders are quickly running out of room to store crude. Futures in New York ended the week down 20% after Sunday’s agreement by OPEC+ to cut output by almost 10 million barrels a day. The agreement wasn’t enough to overcome signs that energy demand was cratering as people sheltered from the coronavirus pandemic.

China reported that its economy suffered a historic slump in the first quarter, OPEC predicted demand for its oil will fall to a three-decade low and U.S. and Europe inventories swelled. Meanwhile, prices in the physical oil market have disconnected from futures, with landlocked crudes such as Bakken and Western Canadian Select worth about $11 to $12 a barrel.

In the U.S., a key exchange-traded fund plans to move some of its giant futures position to a later month. The move comes as near-term prices for U.S. crude are trading at huge discounts to later-dated contracts on concern the storage hub of Cushing, Oklahoma, will fill to capacity. That has seen prices disconnect from Brent futures in London.

“There is a squeeze going on at Cushing,” Sandy Fielden, director of research for Morningstar Inc., said by phone. “People who have futures contracts, if they can’t close them now, they have to deliver.”

West Texas Intermediate futures for May, which expires next week, are at an almost $7 a barrel discount to June futures, close to the biggest spread between the front and second month contracts in 11 years. Dated Brent was assessed at $18.86 on Thursday, according to S&P Global Platts, far below futures prices, and real cargoes are trading at even steeper discounts. “You are delivering oil into the worst delivery situation in recent memory,” Phil Flynn, senior market analyst at Price Futures Group Inc., said by phone.