The day started like any other gloomy Monday in the oil market’s worst crisis in a generation. It ended with prices falling below zero, thrusting markets into a parallel universe where traders were willing to pay $40 a barrel just to get somebody to take crude off their hands.

The move was so violent and shocking that many traders struggled to explain it. They grasped wildly at possible causes all day long — had some big firm got caught wrong-footed? Or were inexperienced retail investors flummoxed by a market quirk? — but had no tangible evidence of anything to point to.

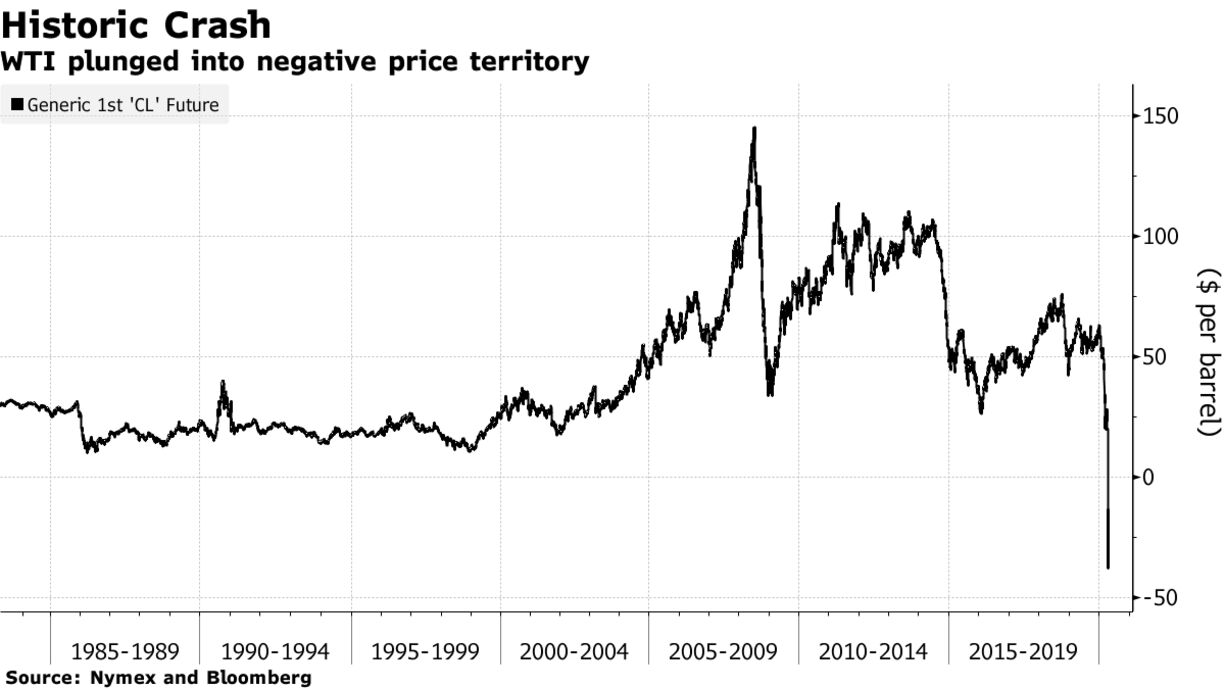

West Texas Intermediate futures have been the benchmark for America’s oil industry for decades, seeing the market through booms, busts, wars and financial crises, but no single event holds a candle to this. By the end of trading, the contract had slumped from $17.85 a barrel to minus $37.63.

“Today was a devastating day for the global oil industry,” said Doug King, a hedge fund investor who co-founded the Merchant Commodity Fund. “U.S. storage is full or committed and some unfortunate market participants were carried out.” Prices recovered on Tuesday, but were still trading at minus $3.43 a barrel at 10:13 a.m. London time.

In one way, the negative plunge was just an extreme glitch as traders prepared for the expiry of the contract for delivery in May. Elsewhere, the market proceeded as normal — Brent futures, the benchmark for Europe in London, ended the day down sharply, but still above $25 a barrel. WTI for June delivery changed hands at $20 a barrel.