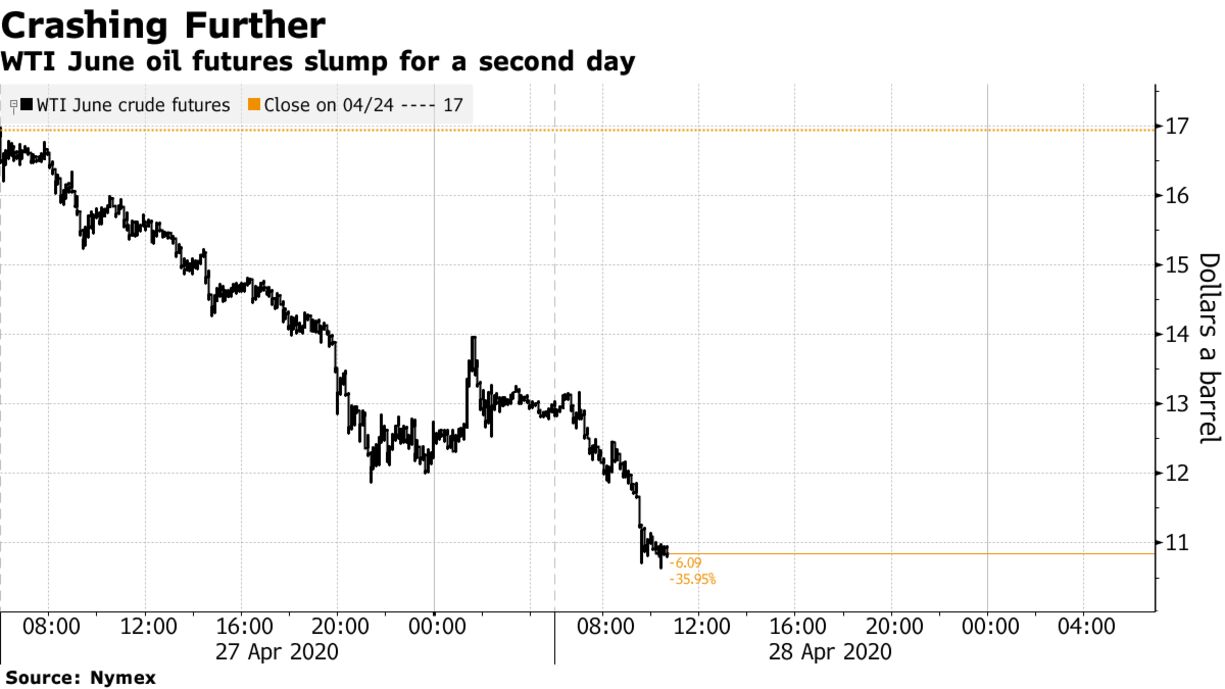

Crude extended its slide to near $10 a barrel as exchange-traded funds and indexes flee the volatility of nearby futures contracts following the market’s plunge below zero last week. Futures fell in New York after losing more than $4 on Monday. S&P Dow Jones said it will roll all of its West Texas Intermediate crude contracts for June into July on Tuesday, due to the risk that June prices go negative. The United States Oil Fund LP is also selling all of its WTI June contracts, while several other ETFs have said they will sell near-term contracts and buy later ones.

The moves are depressing near-term WTI prices versus those further out, with June futures now more than $7 below July. The U.S. benchmark is also about $9 cheaper than global benchmark Brent futures as a result of the selling, which has seen holdings in the June contract fall by more than 40%.

Oil has lost more than 80% this year as the coronavirus outbreak vaporized demand for everything from gasoline to crude despite global efforts to stem the spread. The world’s biggest producers have pledged to slash daily output from the start of next month to try and balance the market, but the collapse in consumption has led to a swelling glut that’s testing storage limits worldwide. U.S. producers have started making crude deliveries to the nation’s emergency stockpile as storage space runs out.

“We are seeing the exodus away from the Nymex WTI June contract growing,” said BNP Paribas’ head of commodity-markets strategy Harry Tchilinguirian. The move is “still motivated by the risk of negative prices that can emerge with the testing of storage capacity limits at Cushing,” the U.S. storage hub in Oklahoma.