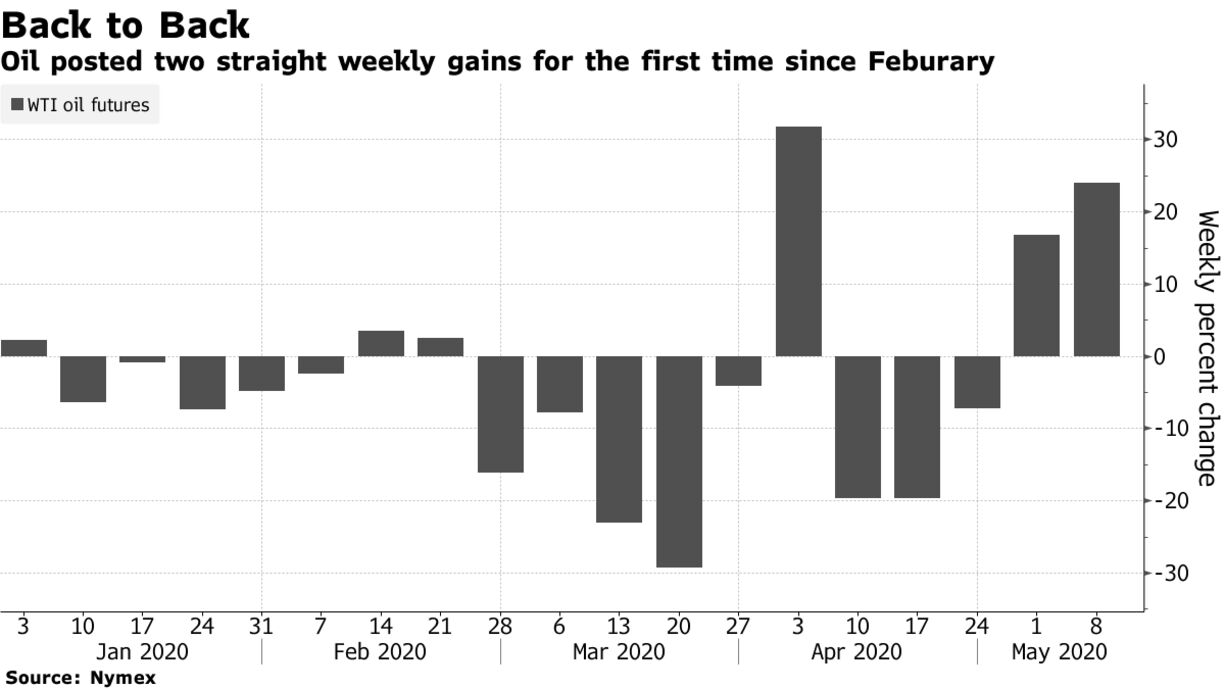

Oil notched its first back-to-back weekly gain since February amid optimism around production cuts beginning to eat into a massive supply glut. Futures in New York climbed 25% this week. Explorers are cutting production in response to crude oil trading in the $20-a-barrel range. EOG Resources Inc. is cutting about a quarter of its oil production for May in one of the biggest U.S. shale retrenchments to date.

The number of U.S. rigs drilling for oil fell to a level not seen since before the shale-oil revolution kicked off at the beginning of the last decade. “We’re getting good supply news,” said Bart Melek, head of commodity strategy at Toronto Dominion Bank. “There is a bit of risk appetite.” Though he cautioned that the market is not out of the woods yet as it stares down the enormous supply overhang.

As rigs shut and nationwide production lessens, signs of a demand recovery are also occurring, with drivers hitting roadways as coronavirus-led lockdowns ease.

“There is a feeling that we are through the worst of the economic crisis and we are past this peak supply, demand imbalance,” said Peter McNally, global lead for industrials, materials and energy, at Third Bridge. “The supply outlook is heading in the right direction.”

This week’s data from the Energy Information Administration proved supportive. U.S. gasoline supplied, an indicator of consumption, rose by the most in almost two years last week and nationwide crude production declined for a fifth straight week to the lowest since July 2019.