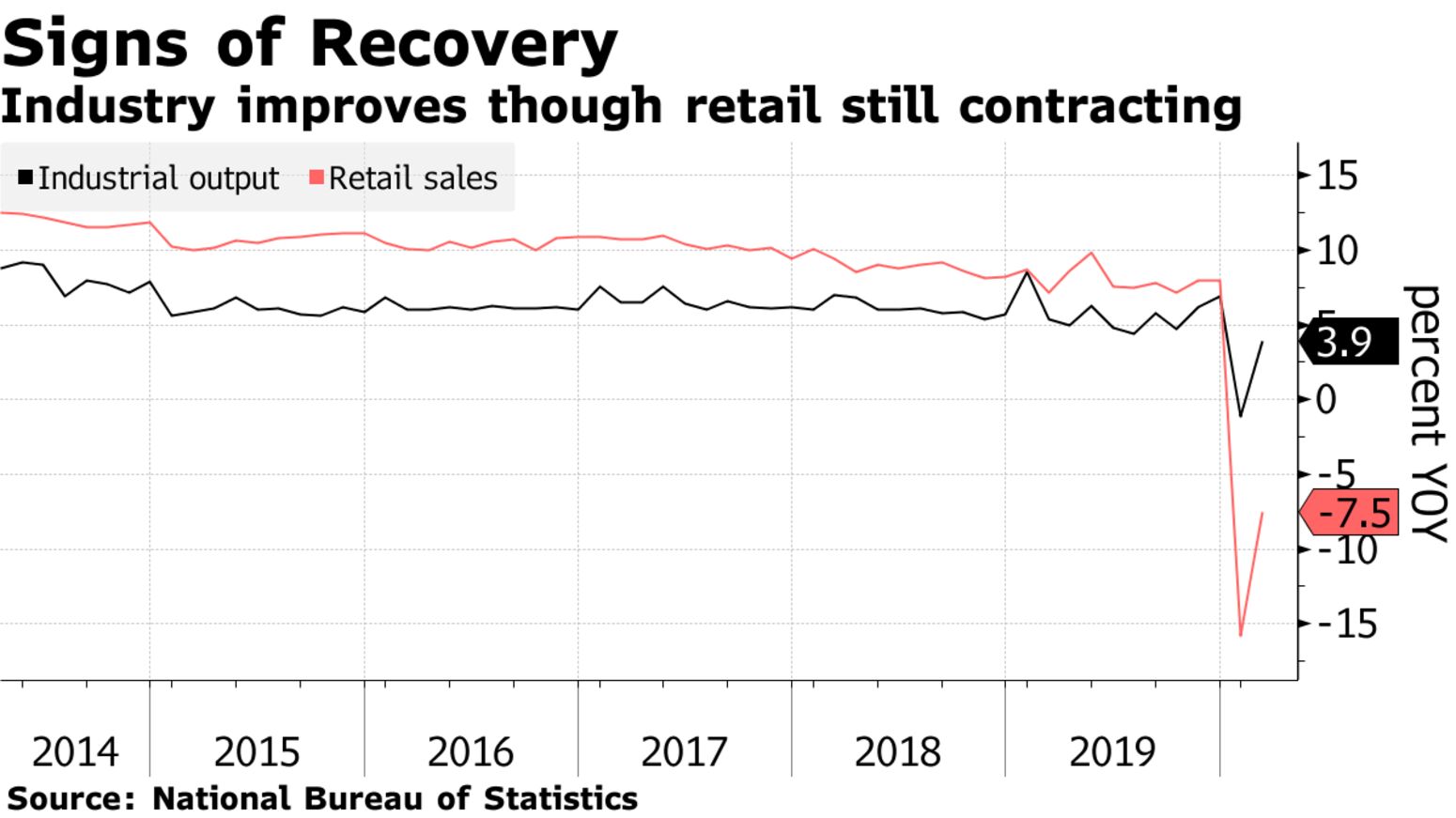

China has a lesson for the world: An economy is harder to reboot than it is to shut down. Fresh data for the month of April, covering a period when the government pushed hard to reopen the economy as the coronavirus came under control, show that retail sales continue to fall as consumers shun restaurants and curb spending on other non-essential items.

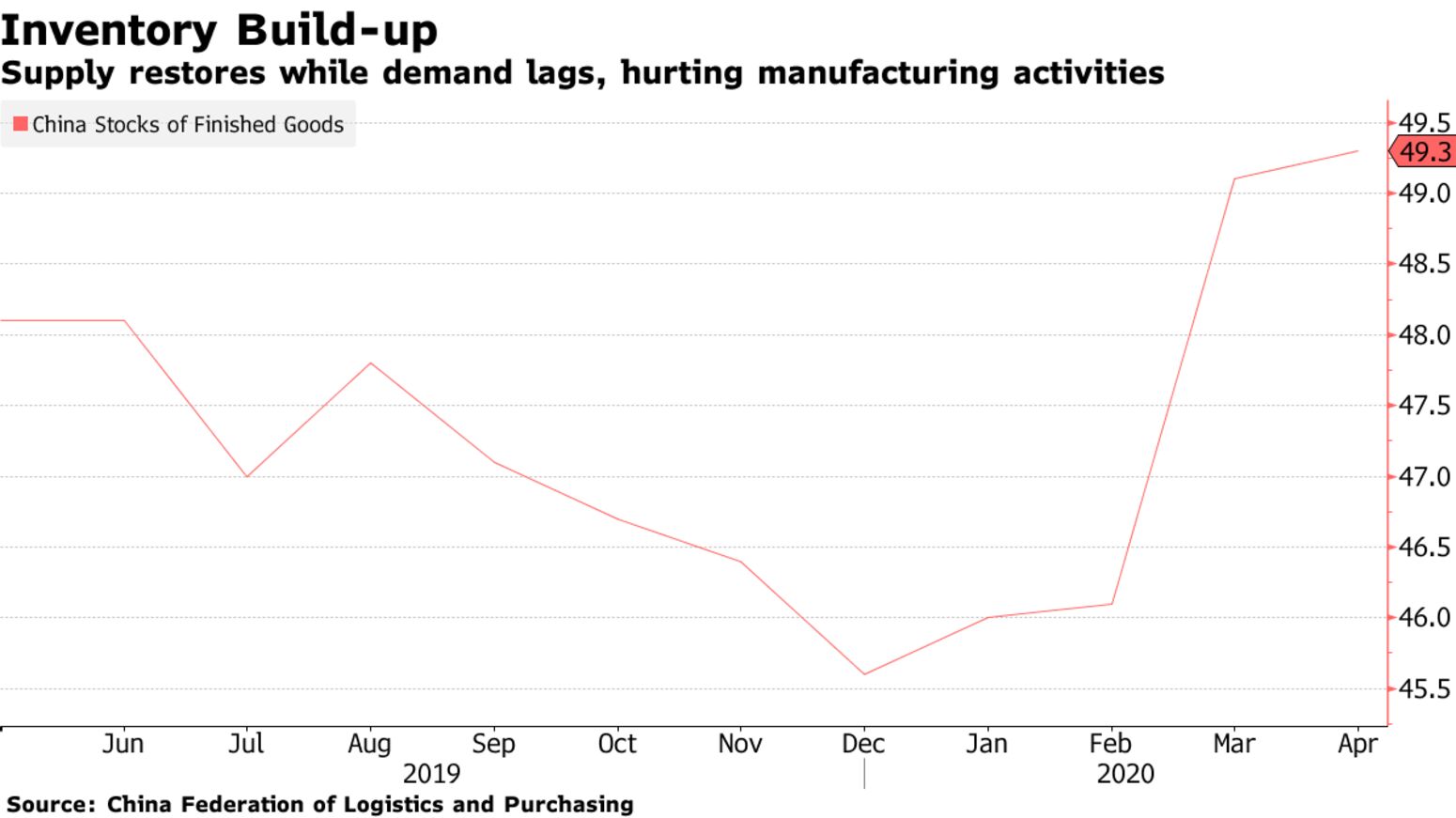

The data underscore that China’s economic recovery will be gradual, with little sign of the kind of snap-back some had expected when the crisis began. It also suggests a revival led by supply will create excess capacity and disinflation unless demand soon catches up — both at home and abroad.

“Unlocking the economy is a more challenging and complex task than locking it down,” said Chua Hak Bin, a senior economist at Maybank Kim Eng Research Pte. in Singapore. China’s experience is sobering for governments seeking to ease virus-related curbs in the hope of offsetting the deepest recession in decades. Policy makers including Federal Reserve Chairman Jerome Powell and International Monetary Fund Managing Director Kristalina Georgieva have warned that recovery is still a way off.

Some signs of China’s recovery — especially in production — could be seen in a sweep of data released Friday that showed industrial output rose a better-than-expected 3.9% from a year earlier, reversing a drop of 1.1% in March and a deep slump in the first two months of the year. Fixed-asset investment decreased 10.3% in the first four months, a smaller decline than the 16.1% drop in the January-March period.