The stock rally fed by bets on a speedy global economic recovery from the pandemic paused for breath on Thursday as equities struggled in Europe and Asia. The dollar strengthened after five consecutive sessions of declines. The Stoxx 600 Index dipped for the first time this week, and futures on the S&P 500 and Nasdaq 100 gauges edged lower, a day after the tech-heavy index traded briefly above its record-high close. Stocks in Asia were mixed, with an MSCI benchmark of global equities stalling just short of having recouped three-quarters of its tumble from a February record.

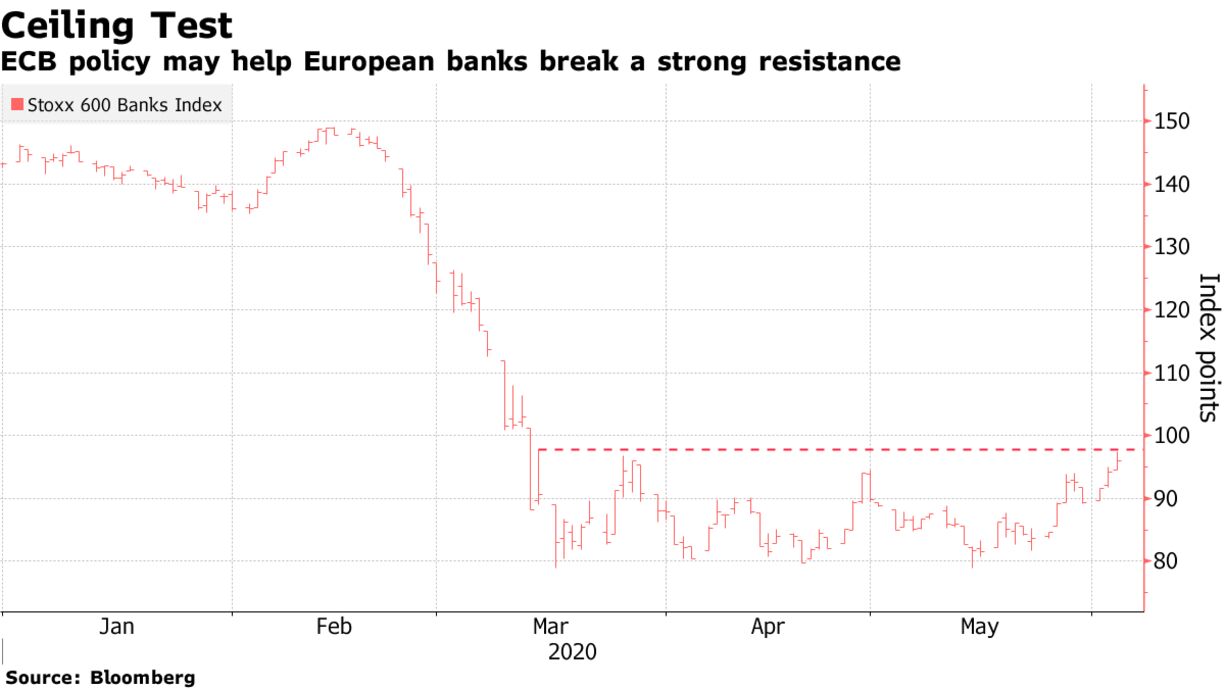

Treasuries were steady, while government bonds fell across most of Europe hours before the ECB announces its policy decision. Australian 10-year yields rose back above 1% for the first time since March.

After exceptional gains for equities in the past week, investor focus now turns to Frankfurt, where the ECB is expected to boost an already massive monetary stimulus, and to Washington, where U.S. employment data will signal the extent of the damage to jobs. Traders may look for further tailwinds to risk assets as economies manage to reopen across the world with little retrenchment.

On the stimulus front already on Thursday, Chancellor Angela Merkel’s coalition agreed on a sweeping 130 billion-euro ($145 billion) package designed to spur short-term consumer spending and get businesses investing again. Elsewhere, oil declined from a three-month high as OPEC+ unity was threatened by a long-running feud and U.S. data cast doubt on the strength of the demand recovery.