U.S. crude futures edged lower with investors concerned that lackluster demand through the summer months will weigh on the market’s recovery. As coronavirus infections rise across much of the U.S., major fuel-consuming states including California, Florida, Arizona and Texas have reimposed stricter measures to curb the spread. Gasoline demand could fall by 17% in July from the same time last year if lockdowns are reintroduced, according to JBC Energy GmbH.

“The coronavirus impacts in the country are causing folks to hunker back down again,” said John Kilduff, a partner at Again Capital LLC, a New York hedge fund focused on energy. “This could be a real problem for the market going forward.”

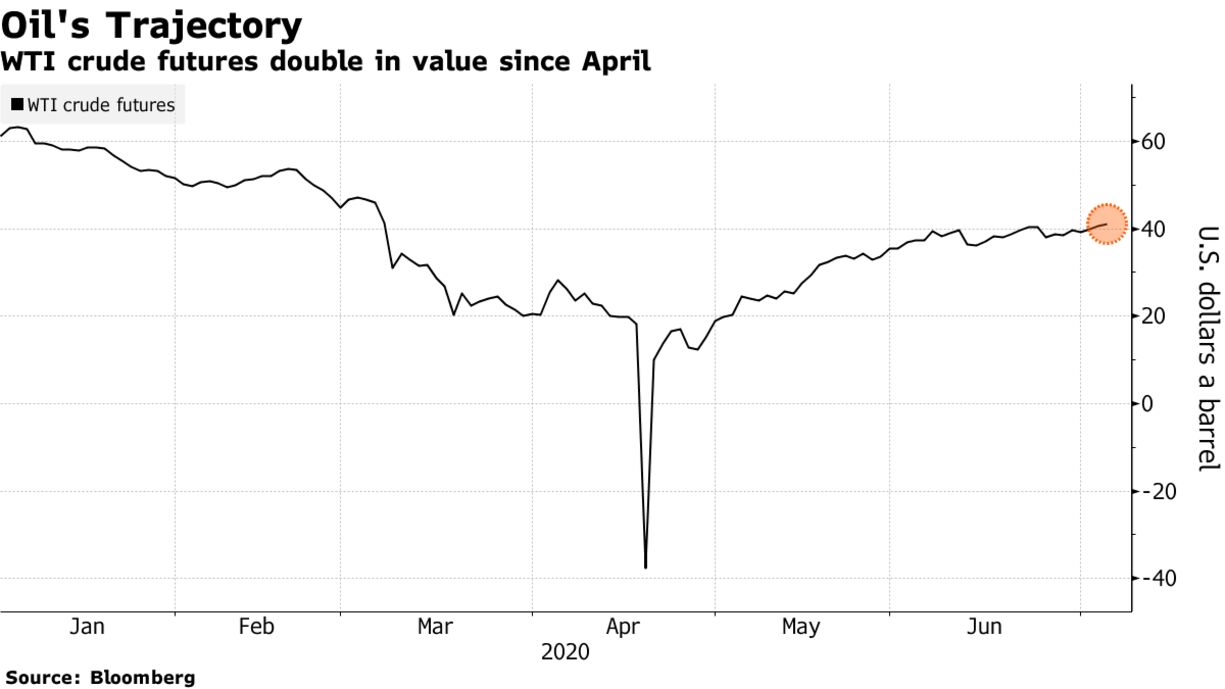

While the U.S. benchmark crude has doubled in value since April to just above the $40-a-barrel mark, futures are having trouble rallying beyond that level amid uncertainty over re-openings across the country.