Oil slipped for a second day on signs of a slower emergence from lockdown in some corners of the globe. Futures fell by as much as 2.6% in New York. California, one of the largest gasoline-consuming states in America, announced on Monday that it would pull back on reopening efforts, the latest red flag for the return of oil demand. This isn’t just happening in America — Hong Kong imposed its strictest social distancing measures yet and Japan said a new state of emergency is possible if infections increase.

Crude’s drop was part of a broader downward move in markets, as the economic hit of rising virus cases continues to grow. European equity markets extended a global retreat.

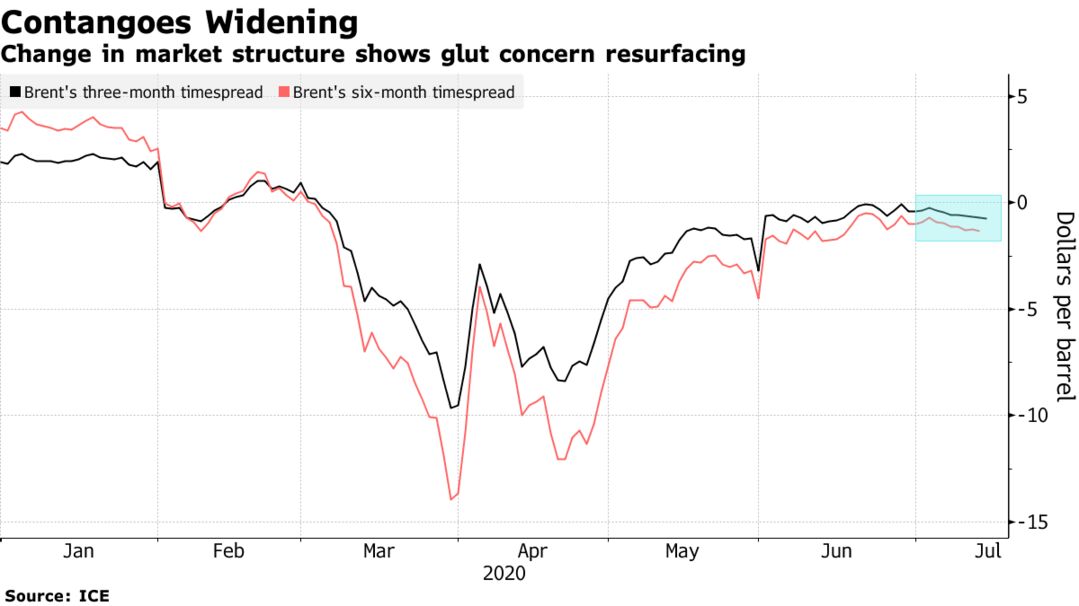

An OPEC+ committee meets Wednesday to discuss easing record output curbs that have helped the market recover. The group is expected to stick to its plan of tapering the cuts from August even as the coronavirus rages unabated in many parts of the world. An increase in supply from OPEC+ would hit a global economy that’s still far from pre-virus levels of activity, with a range of indicators in the U.S. suggesting the recovery has slowed in the past few weeks.

| PRICES: |

|---|

|