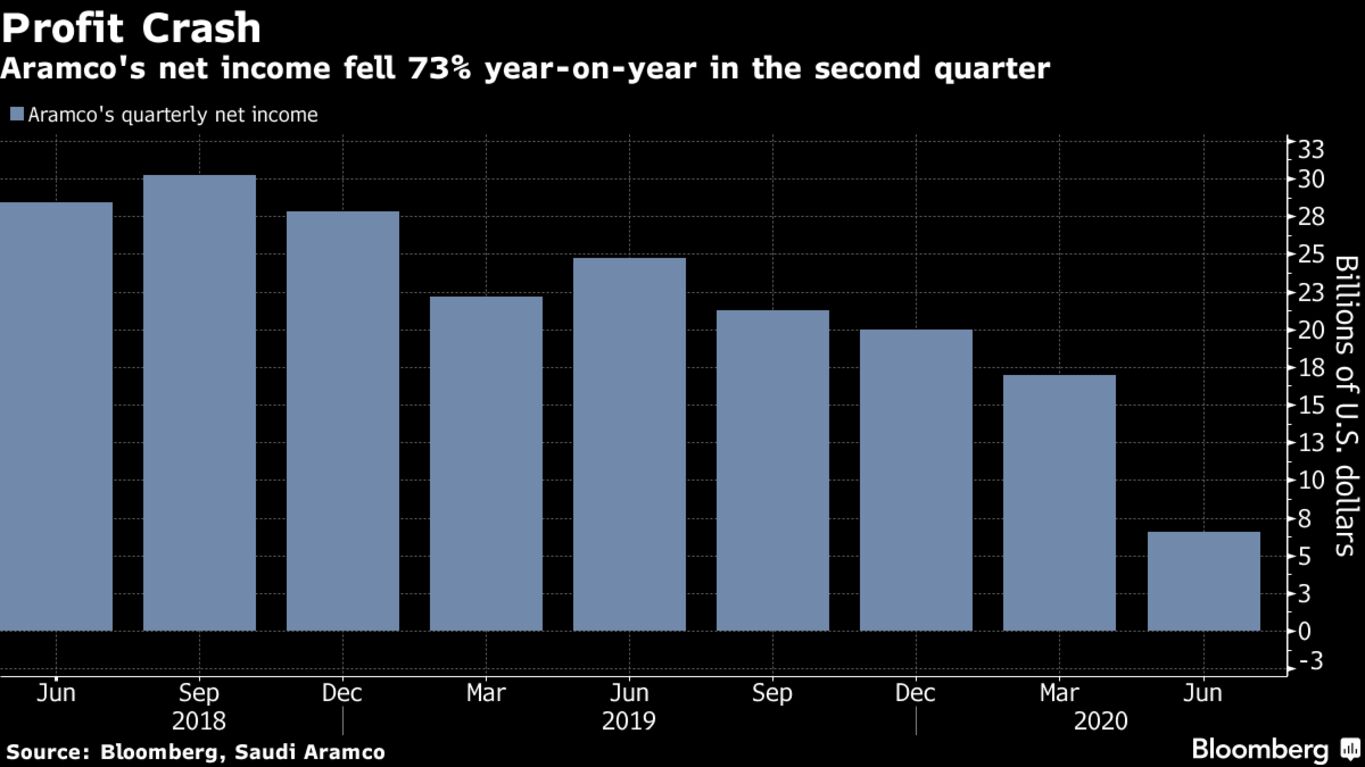

Saudi Arabia’s state-controlled oil giant pressed ahead with a plan to pay $75 billion in dividends this year despite sliding profit and a surge in debt, as the kingdom battles a widening budget deficit. Saudi Aramco said net income for the three months ending in June fell to 24.6 billion riyals ($6.6 billion), down 73% from a year earlier, after crude prices collapsed. Aramco will pay a dividend of $18.75 billion for the quarter, most of it to the government, which owns around 98% of the company’s stock.

Aramco’s performance and demand for energy will probably improve over the rest of the year as nations ease coronavirus lockdowns, according to Chief Executive Officer Amin Nasser.

The results cap a turbulent period for the world’s biggest oil exporter. Prices briefly turned negative in the U.S. in April as the virus battered the global economy and Aramco slashed hundreds of jobs. Saudi Arabia and Russia led a push by the Organization of the Petroleum Exporting Countries and its partners to reduce production and prop up crude prices. Although they’ve rallied, Brent is still down 33% this year.

Saudi Arabia generates most of its revenue from crude, and its budget deficit is set to exceed 12% of gross domestic product in 2020, according to the International Monetary Fund. That would be the widest since 2016, adding pressure on Aramco to maintain dividend payments.

The shares of Aramco, which Apple Inc. dethroned last month as the world’s most valuable listed company, rose 0.3% to 33.05 riyals in Riyadh on Sunday. They’ve declined 6.2% this year, much less than the likes of Exxon Mobil Corp., which has fallen 38%, and Shell, down 50%.