Oil was steady near $43 a barrel after the International Energy Agency cut forecasts for global oil demand. Futures in New York edged higher though the agency reduced its estimates for almost every quarter through to the end of next year, citing the muted outlook for air travel. Russia’s energy minister said the market is stabilizing and that OPEC+ plans no sharp moves.

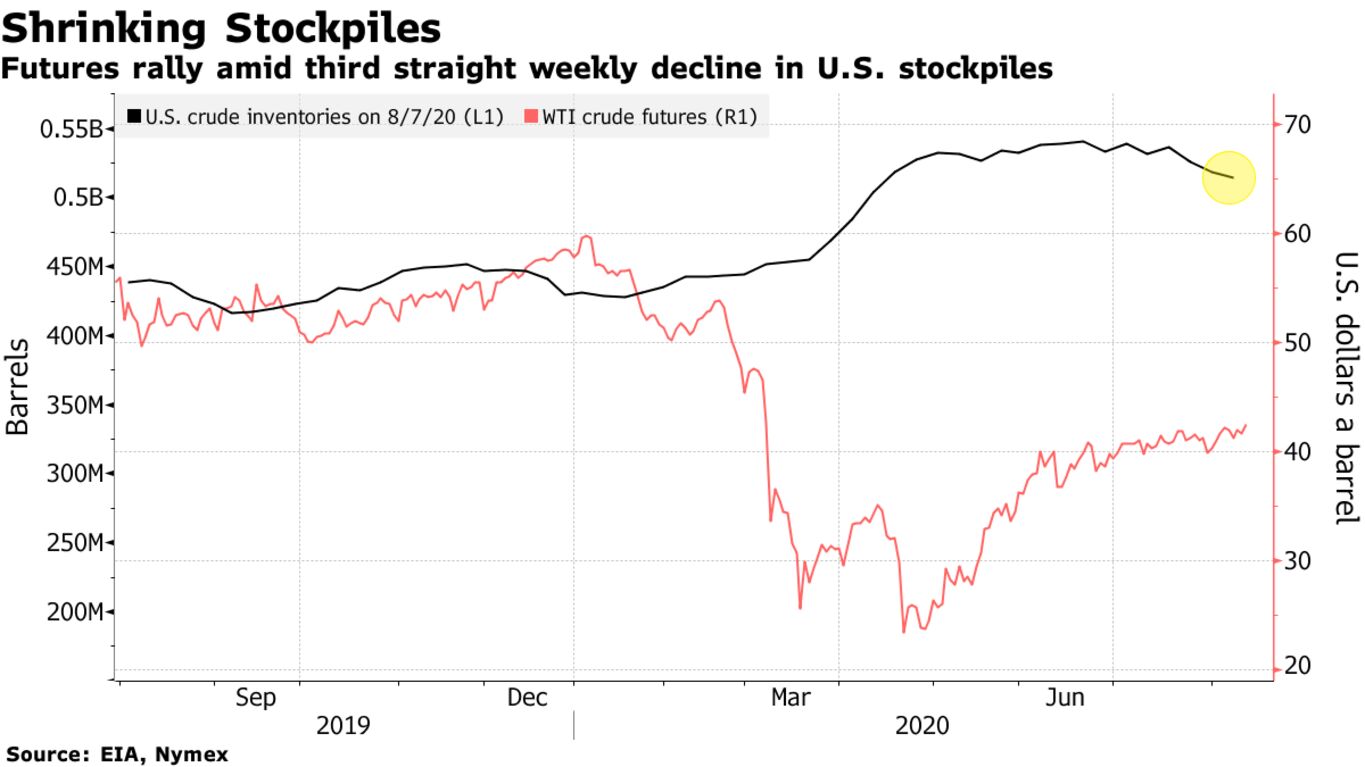

Prices have been trading near a five-month high in recent sessions as U.S. crude inventories declined for a third week. While gasoline demand in America is recovering, the picture for oil products has been far more mixed in other corners of the globe as the pandemic continues to spread. The IEA’s report followed those from OPEC and the U.S. Energy Information Administration earlier in the week, both of which included revised views on U.S. oil production.

“Three oil market reports are driving one conclusion: caution,” said Ole Hansen, head of commodities strategy at Saxo Bank. “We are not out of the woods just yet and the three all highlight the continued uncertainty in predicting the short-to-near-term future.”

| PRICES |

|---|

|