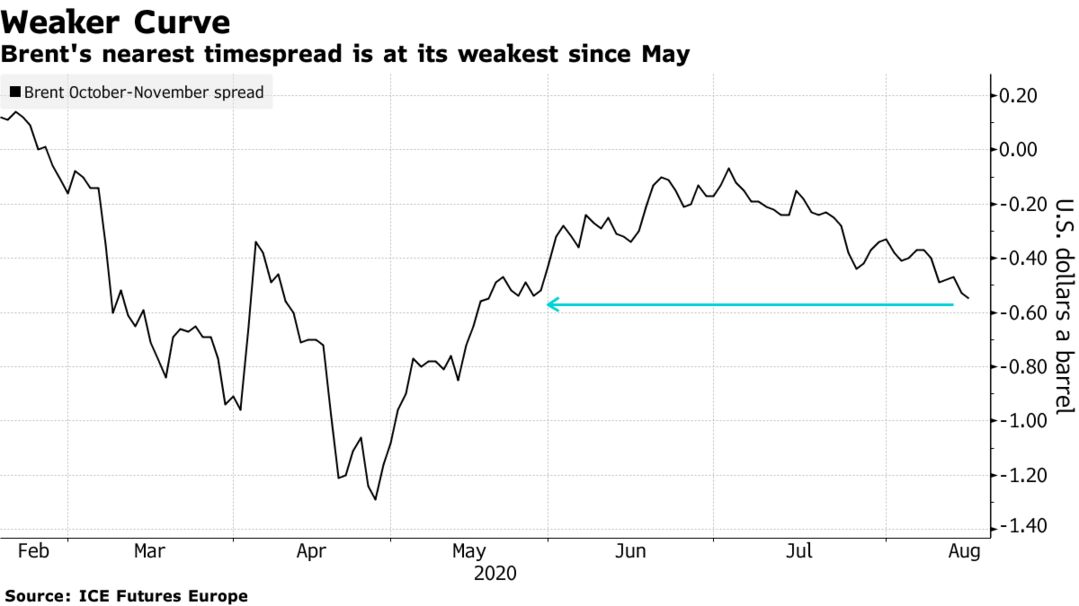

Oil fell below $42 a barrel in New York at the start of a week that will see OPEC+ gather to assess its supply deal as countries struggle to contain the virus that’s hurt economies and fuel demand globally. The Joint Ministerial Monitoring Committee — the panel which reviews the deal between the Organization of Petroleum Exporting Countries and its allies– is poised for a planned meeting on Wednesday, with the group starting to return some crude supply to the market this month following deep reductions. OPEC+ will meet as pockets of the market have started to weaken in recent weeks. Futures for the Middle East’s Dubai benchmark are trading lower now than for future months, known as contango, which indicates oversupply. For the global Brent benchmark, that structure was the weakest since May.

Oil has largely held above $40 in recent weeks as weakness in the dollar has helped support headline prices. However, the market is still facing headwinds including rising virus infections and fraying U.S.-China tensions, which may derail a nascent demand recovery. On Friday, the U.S. seized four tankers carrying Iranian gasoline bound for Venezuela in an unprecedented move that carries the potential to destabilize global oil shipments if Iran retaliates.

OPEC+ will seek “to keep compliance high,” said Ole Hansen, head of commodities strategy at Saxo Bank A/S. “Now is most certainly not the time to talk about bringing more barrels back to the market.”