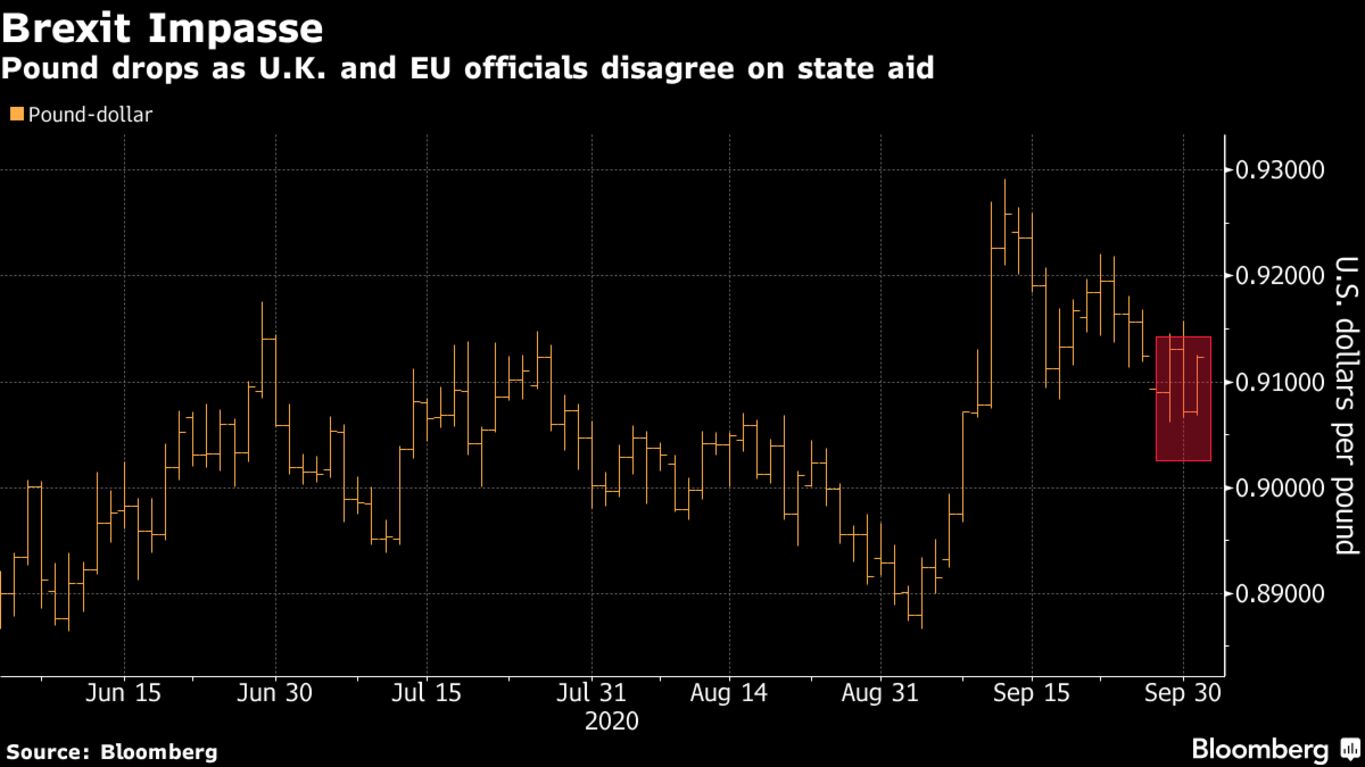

The pound tumbled after a report that Brexit talks were failing to close differences and as the European Union planned legal action against the U.K., dashing hopes the two sides could move toward a trade deal this week. Sterling snapped a three-day winning streak after news that the U.K. and EU remain split on the issue of state aid, a sticking point in the negotiations. The currency deepened losses after a report that the EU would take the first step in a legal process against the U.K. for breaching the terms of its withdrawal agreement from the bloc.

The impasse comes after several days of a more conciliatory tone from British and European officials, and more buoyant risk appetite in global markets, that had helped the pound rally from a two-month low last week. The currency is again serving as a barometer to the Brexit process, after a year dominated by Covid-19.

The EU will send a “letter of formal notice” to the U.K. on Thursday over its internal market bill that would breach its withdrawal terms, a person familiar with the matter said. The U.K. has a month to respond and the process could result in a lawsuit at the European Court of Justice.

The pound fell 0.6% to $1.2849 by 11:00 a.m. in London, and dropped 0.8% to 91.43 pence per euro. Negotiators are due to discuss the issue of state aid later Thursday, after Britain submitted a new round of proposals on how its rules will work after Brexit. The fact that talks could drag on longer could explain why volatility is little changed despite the latest moves in the currency, said Valentin Marinov, head of Group-of-10 currency strategy at Credit Agricole SA.

So-called risk reversal options show that pound traders are in no rush to hedge the risk of a sharp decline in the U.K. currency due to Brexit risks. Sterling has been propped up this year by weakness in the dollar. “The real crunch time for the pound may come in November, especially if the two sides leave it till the last moment to settle their differences,” Marinov said. “This could also leave the pound in a holding pattern for now.”