An official gauge of activity in China’s manufacturing industry fell slightly in October, while consumer spending helped to lift services output, suggesting the economic recovery remains on track.

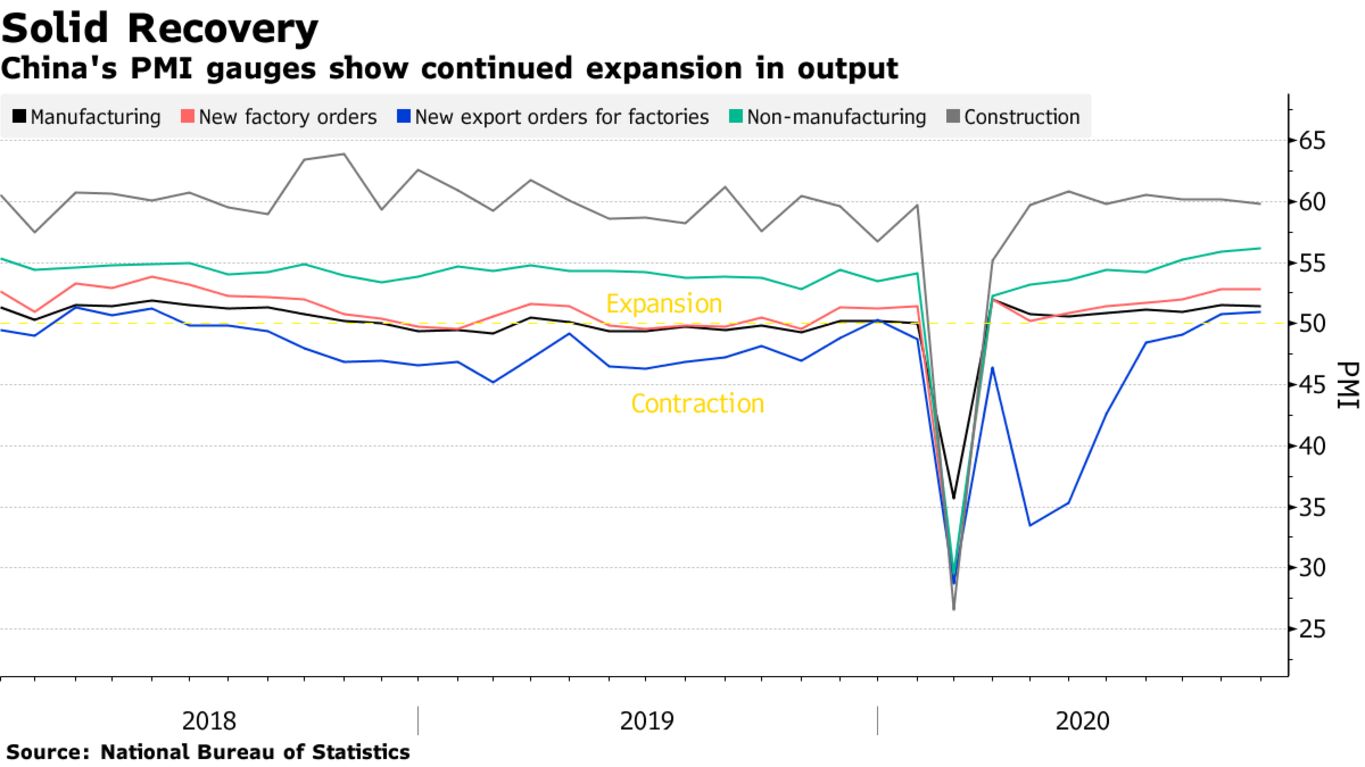

- The manufacturing purchasing managers’ index in October eased to 51.4 from 51.5 in the previous month, according to data released by the National Bureau of Statistics Saturday — largely in line with the 51.3 median estimate in a Bloomberg survey of economists

- The non-manufacturing gauge climbed to 56.2 from September’s 55.9, higher than the median forecast of 56. Readings above 50 indicate improving conditions from the previous month

Key Insights

- The data shows a steady momentum in China’s economic recovery, with industrial production stable and global demand and consumption continuing to pick up. The manufacturing PMI has now been above the 50 mark for eight consecutive months

- Factory output was likely affected by the longer-than-usual golden week holiday in October. At the same time, the holiday gave a boost to consumer spending, especially on travel, helping to buoy the non-manufacturing sector, which includes services and construction

- While China’s domestic demand is improving, the global environment is becoming more uncertain. A resurgence in Covid-19 cases in some of China’s key markets may weigh on the outlook as countries like Germany and France return to various forms of lockdown. China’s early economic indicators showed mixed signals for the recovery in October

- “The second wave of Covid-19 outside China could bolster China’s exports, but may also delay the full recovery of China’s services sector, as Beijing still needs to stay alert,” Nomura Holdings Inc. economists, led by Ting Lu, wrote in a note. “An extended pandemic may eventually dampen demand for China’s exports if the purchasing power in overseas economies diminishes and they adjust their manufacturing to the new normal”

What Bloomberg Economics Says…

“The data suggest there is no urgency for the government to add fresh stimulus by year-end, though we expect an easing bias to be maintained. The only tarnish on an otherwise solid set of data was a drop in the PMI for small companies, which slipped back into contractionary territory.”