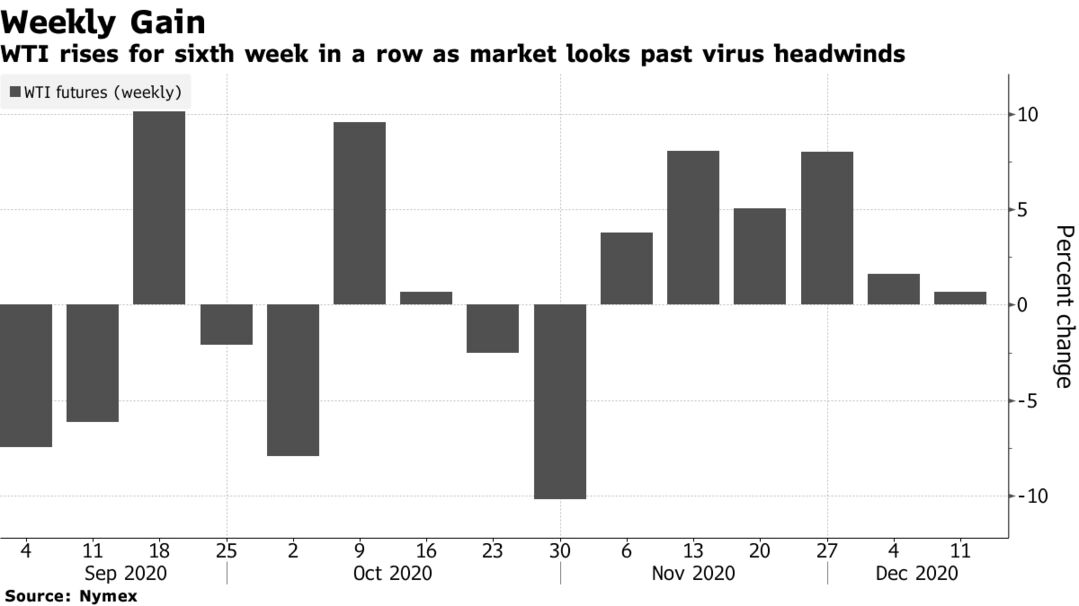

Oil just managed a weekly gain as an impasse in Washington over pandemic relief dimmed chances of an imminent boost to demand. Futures in New York eased off a nine-month high alongside a broader market decline as bipartisan talks on another round of U.S. fiscal stimulus stalled. West Texas Intermediate rose less than 1% for the week. A pullback was largely expected after Brent’s rally above $50 earlier in the week, with a key technical benchmark settling in overbought territory on Thursday.

Still, there are some reasons to give pause, as the market this week shrugged off the second largest U.S. crude build on record. At the same time, oil price upside could be capped early next year as concerns of virus-related lockdowns and rifts in the Organization of Petroleum Exporting Countries present potential near-term headwinds, TD Securities wrote in a report.

| PRICES |

|---|

|