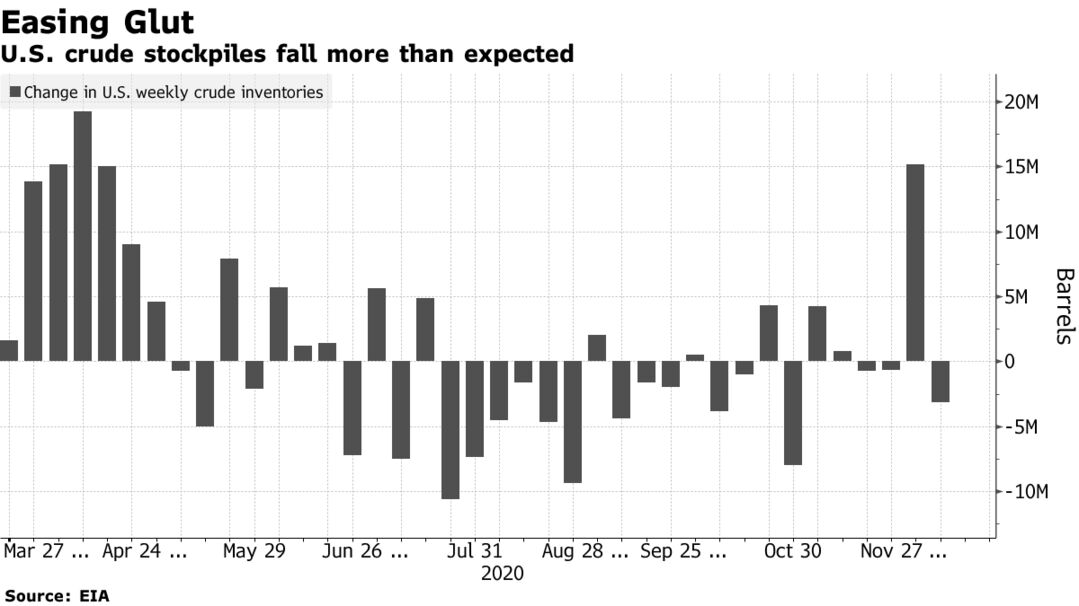

Oil extended gains from the highest settlement in almost 10 months after broader markets rallied and American crude stockpiles declined more than expected.

Futures in New York rose 0.5% to above $48 a barrel. Crude inventories dropped by 3.14 million barrels last week, more than the median estimate in a Bloomberg survey. Equity markets rallied and the dollar fell as optimism grew around a $900 billion U.S. spending package, while Europe expedited the rollout of a Covid-19 vaccine before Christmas.

Oil is up more than 30% since the end of October on optimism about a sustained recovery in demand as the world gets vaccinated, but the market is still facing a number of near-term hurdles including an OPEC+ supply hike next month. The International Energy Agency warned this week that the crude glut left behind by the pandemic won’t clear until the end of 2021.

The physical market, meanwhile, is robust. India’s refineries are running at full tilt and Asian demand has driven the price of Russian, Middle Eastern and U.S. barrels higher. There are signs, however, of weakening consumption from some countries in the region including South Korea, as the coronavirus stages a comeback.

| PRICES |

|---|

|