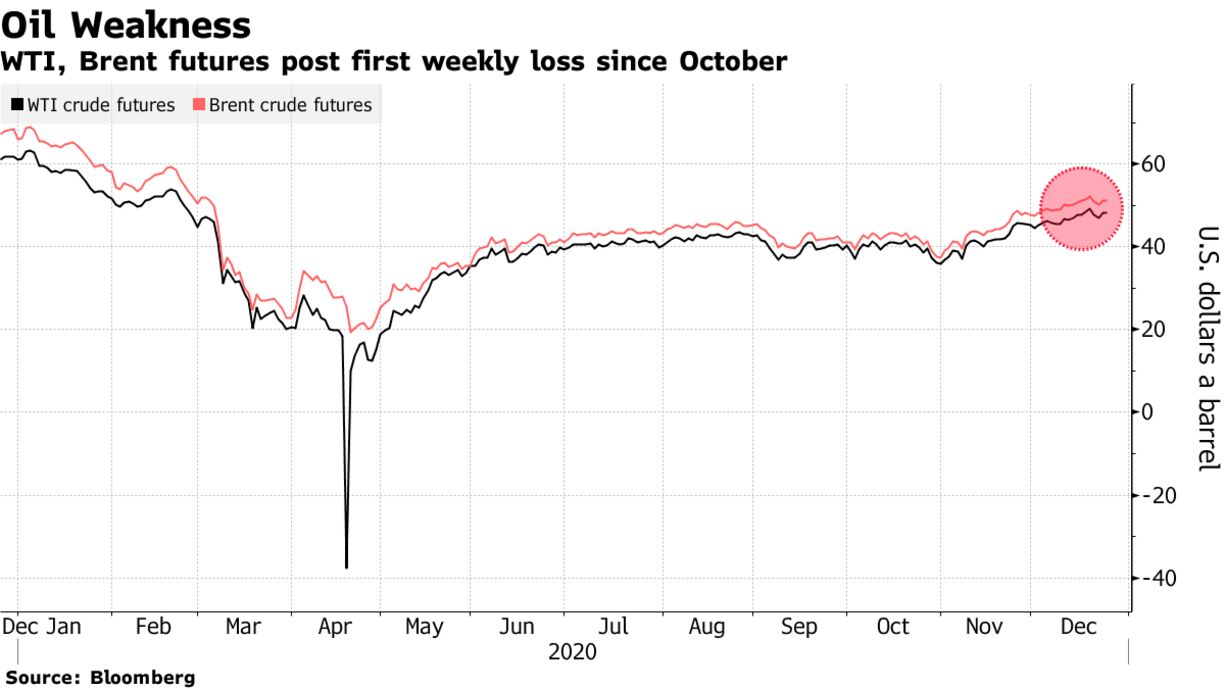

Oil declined for the first week since October as a new coronavirus mutation spreads through parts of the world and poses risks to energy demand in the wake of stricter lockdowns. Futures in New York slid 1.8% this week, yet closed up on Thursday with equities gaining after the U.K. clinched a historic trade deal with the European Union. Tougher restrictions were extended to much of England to contain the new strain of Covid-19, and China said it would pause flights to and from the U.K. A cluster of infections in Sydney is growing and in the U.S., New York City hospitalizations are at the highest since May.

“Any setback in combating the pandemic is met with selling, as we saw this week,” said John Kilduff, a partner at Again Capital LLC. “Demand in the early part of January is looking shaky, especially if more lockdowns come our way, which is increasingly likely if a post-Christmas surge in virus cases materializes.”

After a run of seven weekly gains driven by euphoria over a series of vaccine breakthroughs, oil’s weakness points to the concerns over how long it will take for vaccines to roll out and the impact on energy consumption. At the same time, the OPEC+ alliance plans to add supply back to the market next year, another risk factor.

U.S. lawmakers are still in discussions over a stimulus bill. House Republicans blocked Democrats’ attempt to meet President Donald Trump’s demand to pay most Americans $2,000 to help weather the pandemic.

| PRICES |

|---|

|