One year after the first glimmers of the catastrophe awaiting global oil markets — from deserted Chinese cities to grounded jets — crude is staging a remarkable turnaround. The crisis triggered by the deadly coronavirus was the worst the petroleum industry has ever seen. Fuel demand crashed by a fifth, prices slumped below zero, producers fought viciously over customers, and more than a billion surplus barrels poured into storage tanks around the world. Yet oil’s emergence from the calamity has been stark.

Futures rallied to a one-year high above $60 a barrel in London on Monday as Chinese consumption surpasses pre-virus levels, the vaccine rollout restores confidence, and the OPEC cartel and its allies keep a tight leash on supply.

“The recovery is proceeding at a faster rate than people perceived,” said Ed Morse, head of commodities research at Citigroup Inc. “The demand recovery is going to look stellar. The inventory draw is significantly greater than what many people thought.”

The sudden reversal is a salve for an array of producers. It’s offering supermajors like Exxon Mobil Corp. and BP Plc a glimmer of hope after a grueling year. For countries like Iraq and Angola, which have sought aid from the International Monetary Fund to quell economic crises, it’s a lifeline. Even wealthier exporters like Saudi Arabia consider the extra revenue crucial.

Plunging Stockpiles

The strongest sign of the recovery is one of the most esoteric — a price structure known as backwardation. Near-term futures contracts have built up a sizable premium relative to later months, indicating immediate supplies are tightening fast.

One gauge watched closely by crude traders — the difference between contracts based on North Sea Brent crude settling in December versus those a year later — has surged to a two-year high of $2.84 a barrel.

That’s a signal for refiners to dig into the huge stockpiles that built up during the worst of last year’s demand slump. These inventories are plunging everywhere, from major depots in the U.S., China and the United Arab Emirates to the tanker fleet once commandeered to house spare barrels at sea.

Global inventories have declined by about 300 million barrels since the Organization of Petroleum Exporting Countries and its partners made deep production cuts in May, the International Energy Agency estimates.

The cartel projects that it will deplete another 82 million barrels this quarter, pushing stockpiles in industrialized nations down to their five-year average by August. Bloated inventories weigh on oil prices, so eliminating the overhang could pave the way for a further recovery.

“We are drawing stocks,” said Ben Luckock, co-head of oil trading at Trafigura Group in Geneva. Prices have recovered well and “can seriously perform come summer both in crude and in products.”

Asian Recovery

One of the forces driving this rapid turnaround is the rebound in oil consumption, particularly in Asia.

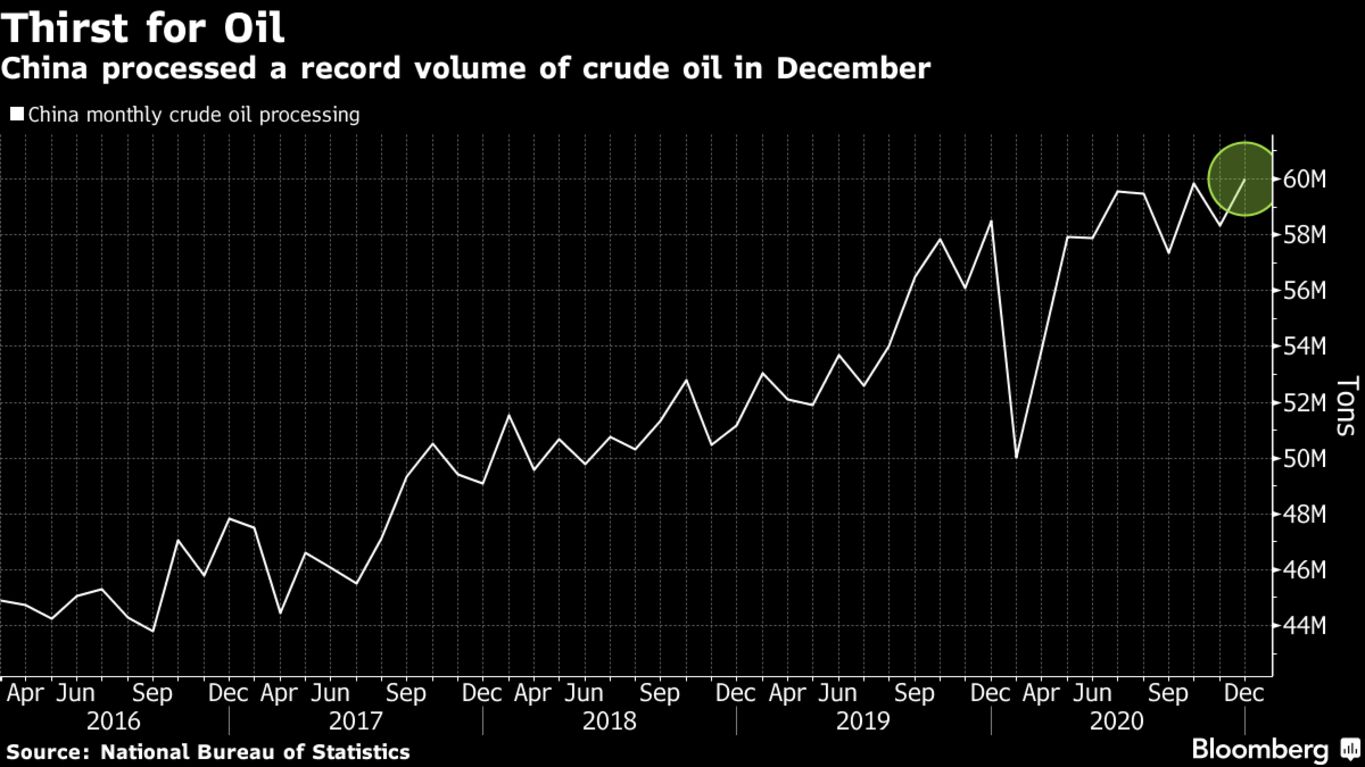

The world’s biggest crude importer’s success at containing the coronavirus has allowed a rapid resumption of economic activity. Government data showed a record stockpile decline in December as processing volumes increased.

In India, fuel consumption has inched back toward normal levels as the spread of the coronavirus prompted the use of more cooking fuel and gasoline. Overall, the nation’s oil-product demand in December was 1.4% lower than year-ago levels, provisional data from its oil ministry showed.