How do you measure the value of the world’s most important commodity? It’s a conundrum that brought uproar in the oil market over the past few weeks after S&P Global Platts, the company that publishes the world’s key crude price, announced on Feb. 22 that it was going to radically change the very nature of that benchmark, known as Dated Brent.

Just nine days after announcing its ambitious overhaul, which had been meant to begin in June 2022, Platts was forced to apologize to the market for the suddenness of the move. A week later it went a step further: the changes would be shelved for an as-yet-undefined period.

“It is not surprising that it caused such an uproar in the market,” Adi Imsirovic, senior research fellow at the Oxford Institute for Energy Studies and an experienced oil trader, said in a paper on the reform. The proposal was “nothing short of revolutionary.”

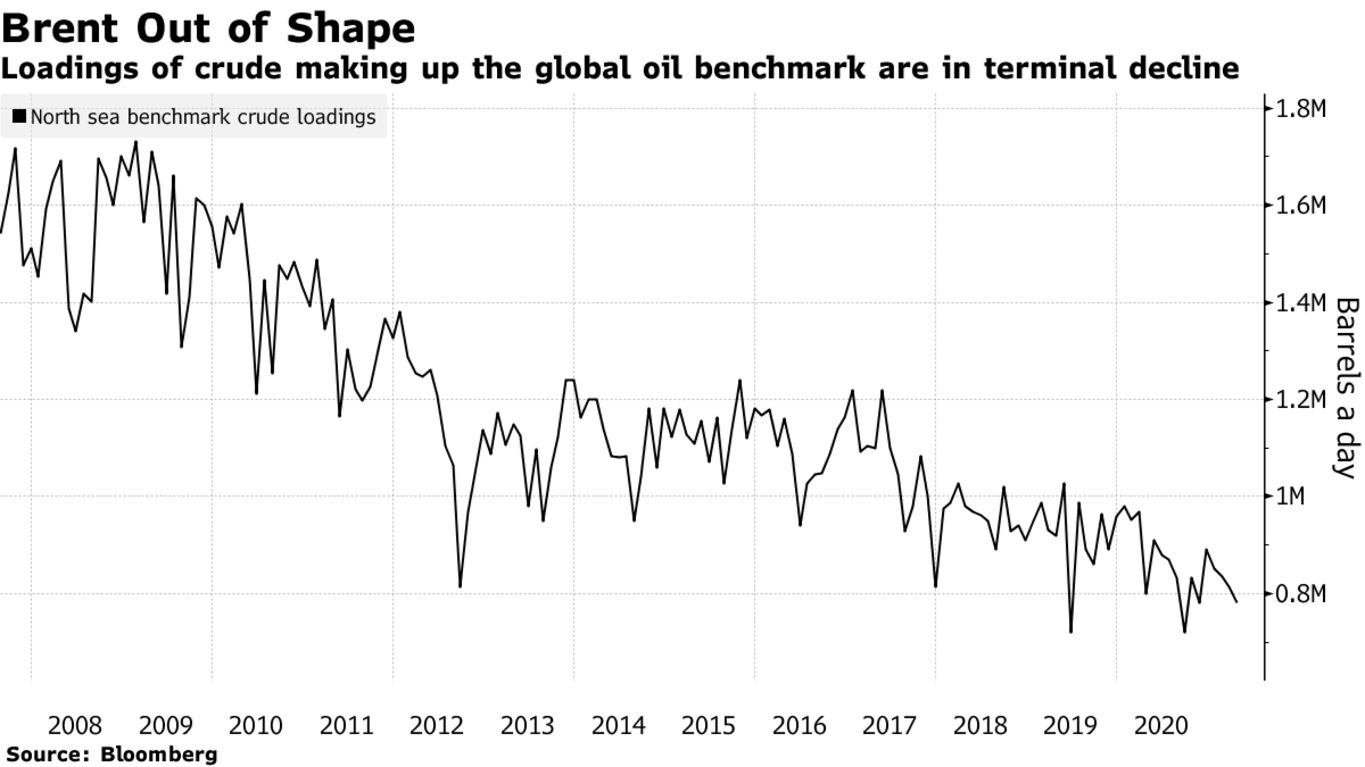

With fewer barrels to trade, the decline poses a threat to the reliability and credibility of a measure that affects everything from crude oil transactions, to long-term refining and drilling contracts. Gas supply deals and a whole host of derivatives — even Brent crude futures — all rely to varying degrees on that one number, published every day some time after 4:30 p.m. in London.

As soon as the changes were announced, it became apparent that parts of the market were unprepared. There was a surge in value and trading of derivatives contracts that reference Dated Brent.

Sellers all but disappeared from the market as uncertainty reigned over how the price would look next year. Both Platts and the Intercontinental Exchange Inc. subsequently issued clarifications that brought prices back down.

Platts says it has made it clear that it will publish a Dated Brent value at the point of loading beyond July 2022. ICE declined to comment.