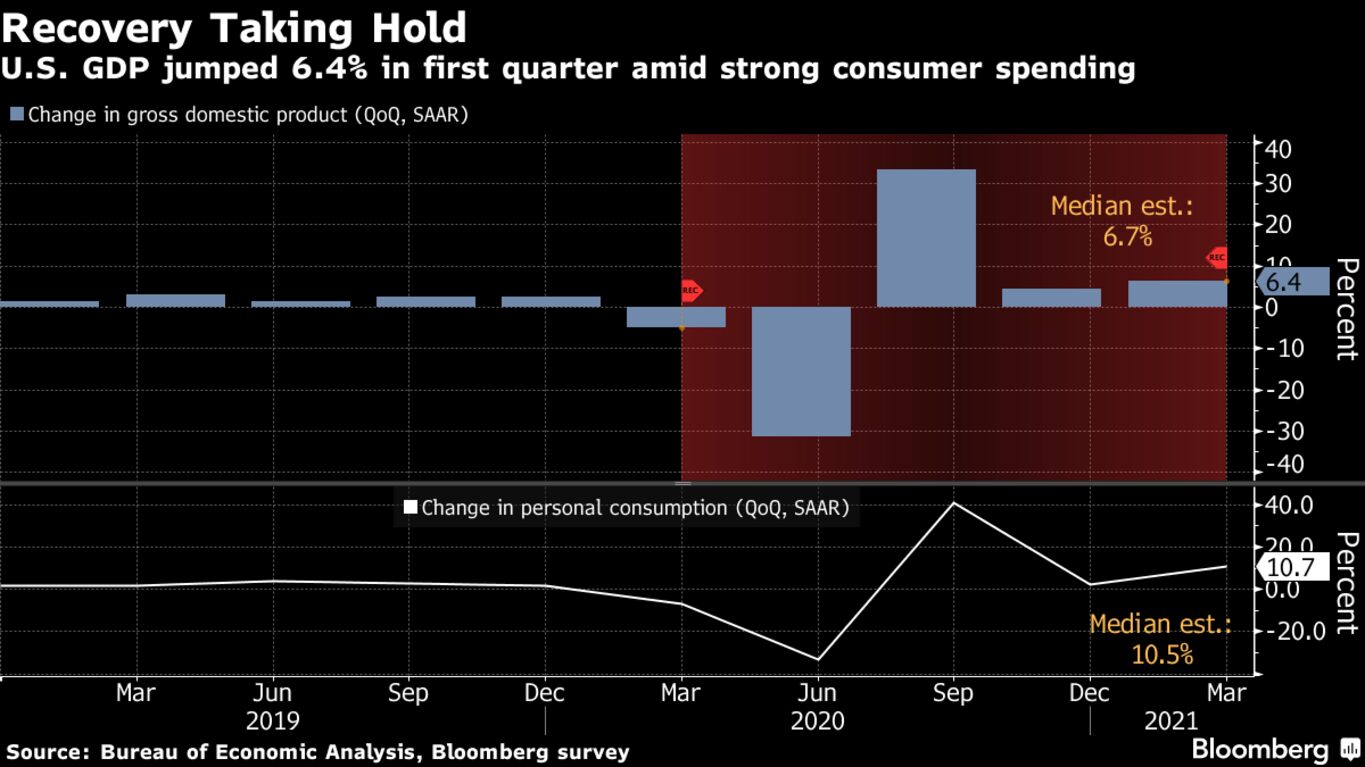

U.S. economic growth accelerated in the first quarter as a rush of consumer spending helped bring total output to the cusp of its pre-pandemic level, foreshadowing further impressive gains in coming months. Gross domestic product expanded at a 6.4% annualized rate following a softer 4.3% pace in the fourth quarter, the Commerce Department’s preliminary estimate showed Thursday. Personal consumption, the biggest part of the economy, surged an annualized 10.7%, the second-fastest since the 1960s.

The inflation-adjusted value of domestically produced goods and services climbed to an annualized $19.1 trillion, indicating GDP will soon eclipse the pre-pandemic peak of nearly $19.3 trillion.

U.S. equities climbed to all-time highs after the GDP report and a batch of corporate earnings.

Rising vaccinations, faster job growth and two rounds of federal stimulus payments combined to supercharge household spending. As government restrictions on activity are widely lifted, consumer demand is seen broadening and driving outlays for long-downtrodden services such as travel and leisure.

A host of high-frequency data, including restaurant and air travel bookings, already confirms a rapidly improving economy that has helped drive stock prices to fresh highs.

The pent-up demand that’s seen driving outsize growth this year is propelling prices skyward at the same time producers are experiencing material shortages and supply-chain challenges. Further, the Biden administration and the Federal Reserve are pushing ahead with policy prescriptions that provide even more juice for the economy.

Read more: Fed Upgrades View of Economy While Keeping Rates Near Zero

The median forecast in a Bloomberg survey of economists called for 6.7% growth in the January through March period.

The pace of government spending jumped at a 6.3% annual rate, the fastest since 2002 and a reflection of federal stimulus. Annualized non-defense outlays climbed by the most since 1963.

The pickup in growth in the January to March period also reflected continued strength in business investment and housing. Non-residential investment rose an annualized 9.9%, driven by equipment and intellectual property, while residential investment increased at a 10.8% rate.

Trade, Inventories

Firm household and business spending has left inventories lean and spurred import demand — two areas that weighed on first-quarter growth. Net exports of goods and services subtracted 0.87 percentage point from GDP, while the change in inventories subtracted 2.64 points.

“When you get a GDP report that features accelerating consumption and declining inventories, it can be considered even stronger than the headline number might suggest,” said Kevin Cummins, chief U.S. economist at NatWest Markets. “I’m really optimistic about the growth path we’re going to have over the next three or four quarters.”

Excluding the trade and inventories components of GDP, final sales to private domestic purchasers, a gauge of underlying demand, accelerated to a 10.6% pace.