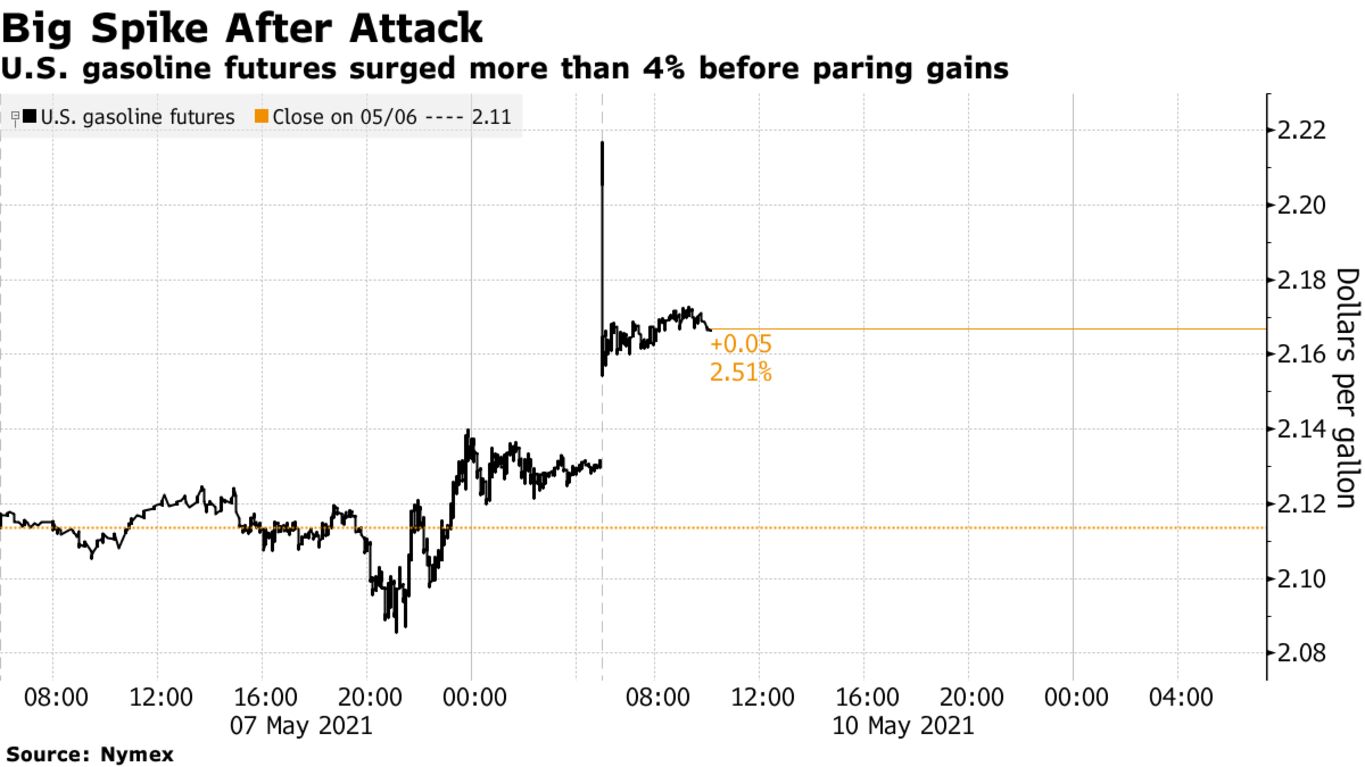

Crude oil climbed along with gasoline in New York after a cyberattack put the largest oil-products pipeline in the U.S. out of action. West Texas Intermediate and Brent both rose as gasoline surged as much as 4.2% to the highest since May 2018, before paring gains. Colonial Pipeline Co., a supplier of gasoline, diesel and jet fuel to the eastern U.S., was forced to halt operations late on Friday, and said Sunday that it is still working toward a restart of the key artery that’s vital to energy flows across the country.

In addition to the unpredictability about when the pipeline’s full capacity will be restored, the fallout will be determined by the geography of the company’s U.S. network and the progress in tackling the pandemic as gasoline and jet fuel demand picks up before summer. While a rush for replacement products could emerge on the East Coast — leading traders to source cargoes from Europe or Asia — Gulf Coast refiners may have to trim runs, hurting U.S. crude demand.

“For now, the market is giving the company the benefit of the doubt that this will be resolved in short order,” said John Kilduff, founding partner at Again Capital LLC. Still, “the pain at the pump will go national, if New York Harbor and other East Coast supply points see supplies dwindle,” he warned.

Oil has surged by a about a third this year as the rapid roll-out of coronavirus vaccines across the U.S. and Europe prompted the lifting of social-distancing measures and travel curbs. Consumption of fuels including gasoline and jet fuel has been on the mend as millions of people return to work, boosting personal mobility and the use of cars. The pipeline’s unexpected outage introduces a new wild card into what was already an complex situation for oil traders just a few weeks after a blockage of the Suez Canal roiled global markets.

| PRICES: |

|---|

|