Oil advanced above $64 a barrel as more signs the U.S. economy is rapidly bouncing back from the pandemic outweighed concern a revival of the Iranian nuclear deal will lead to an increase in global supply. West Texas Intermediate was 0.8% higher, after rising 2.5% on Friday. The spread of coronavirus in the U.S. has slowed further, with the country ending its first week since June with no days of infections exceeding 30,000. Death rates continue to ebb in France and Italy, boding well for energy consumption.

Talks between Iran and world powers will continue in Vienna this week to try and resolve the sides’ remaining differences over the nuclear pact. As part of that process, Iran is likely to extend a U.N. nuclear inspections agreement, buying diplomats time to revive the landmark deal that would usher in an official return of the Persian Gulf nation to world oil markets.

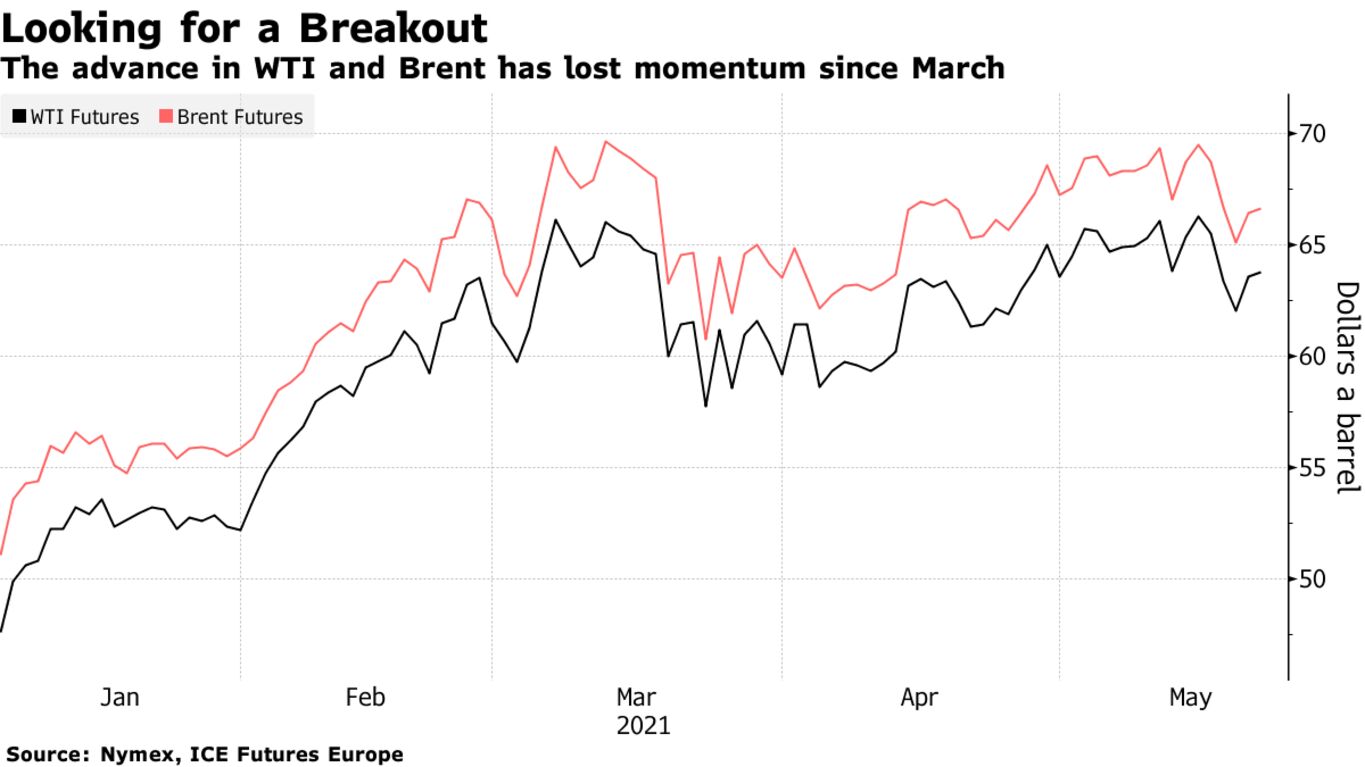

Crude has rallied this year as investors wager the roll-out of vaccines will turn the tide against the outbreak in key economies. Still, that climb has lost some momentum since March as fresh waves of infection roiled Asian economies. At the same time the Iranian talks are making headway, the Organization of Petroleum Exporting Countries and its allies are loosening joint output curbs.

| PRICES: |

|---|

|

Goldman Sachs Group Inc. said the case for higher prices “remains intact,” forecasting Brent was still set to hit $80 this year even if Iranian supplies are restored. The recovery in developed markets’ demand was helping offset weaker South Asian and Latin American consumption, it said in note.

While there are signs the virus is strengthening its grip in parts of Asia, with Malaysia announcing fresh curbs on movement at the weekend, macro-economic signals in developed economies remain positive. In the U.S., a measure of output at manufacturers and service providers hit a record in May.

Oil prices maintained gains even after China intensified a campaign to cool raw materials, pledging a crackdown on excessive speculation. Still, data for April suggest both the nation’s expansion and its credit impulse — new credit as a percentage of GDP — may have crested, putting commodities at risk.

A meeting of the OPEC+ Joint Technical Committee, which was to have taken place on May 25, to assess the state of global supply and demand has been shifted to May 31, according to a person familiar with the matter. The alliance’s next planned ministerial meeting will still take place on June 1.