UK retailers are facing a “mortgage time bomb,” with rising interest rates set to have twice the impact on consumer finances as the recent surge in utility bills, according to a Deutsche Bank analyst.

A “significant” increase in the cost of servicing home loans will reduce disposable incomes by about 5% in 2023, Matt Garland wrote in a note Thursday, adding to pressure on consumers already struggling to contend with soaring inflation.

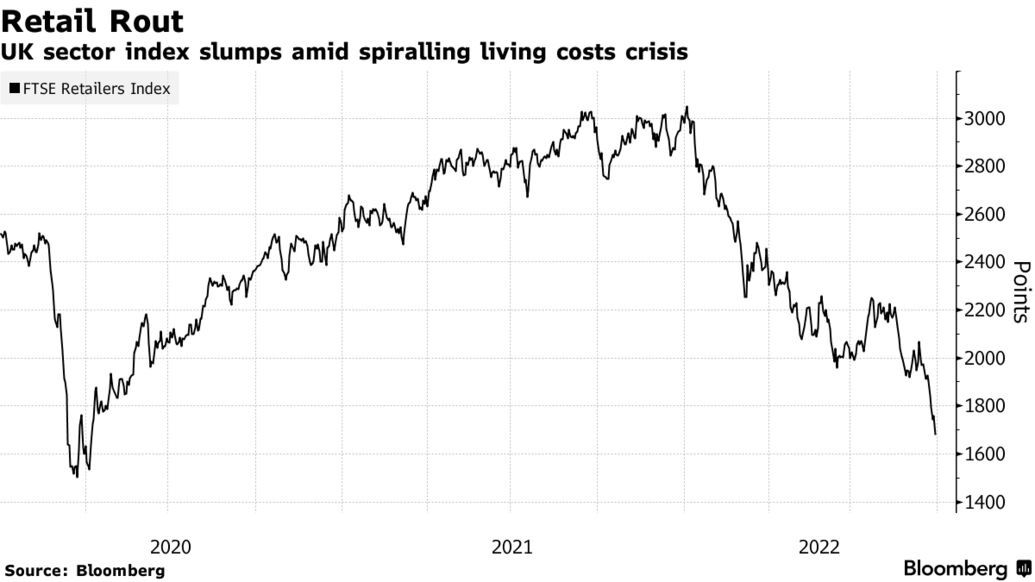

The prediction added to investor jitters on the day that bellwether Next Plc issued its second profit warning this year and Sweden’s Hennes & Mauritz AB reported an 86% slump in third-quarter earnings. Retail stocks tumbled anew, with Next sliding as much as 10% and H&M as much as 7.2%, dragging the Stoxx 600 Retail Index to its lowest level in more than 10 years.

Next Warning, H&M Cuts Add to European Retail Woe as Prices Soar

The pound has dropped about 4% against the dollar since Chancellor Kwasi Kwarteng’s mini budget spooked British investors on Friday, taking a year-to-date decline to 20%.