From Indian tycoon Anil Agarwal’s metals and mining company to American shale explorers, the historic crash in oil prices has left energy companies that loaded up on debt vulnerable. With a global recession looking increasingly likely, commodities firms whose finances were already crumbling due to the outbreak of the coronavirus are suddenly on even shakier ground. In the U.S., defaults by energy companies are likely to exceed the 2016 peak and the risk of so-called fallen angels — or companies that go from investment-grade to junk — has risen, according to Morgan Stanley.

As investors flee risk in credit markets, companies are faced with looming debt bills. Energy and power generation firms globally have about $88 billion of U.S. currency bonds due this this year and the cost to roll over debt has risen, with financial markets seizing up. Read more about how everything is going wrong at once for distressed energy debt issuers.

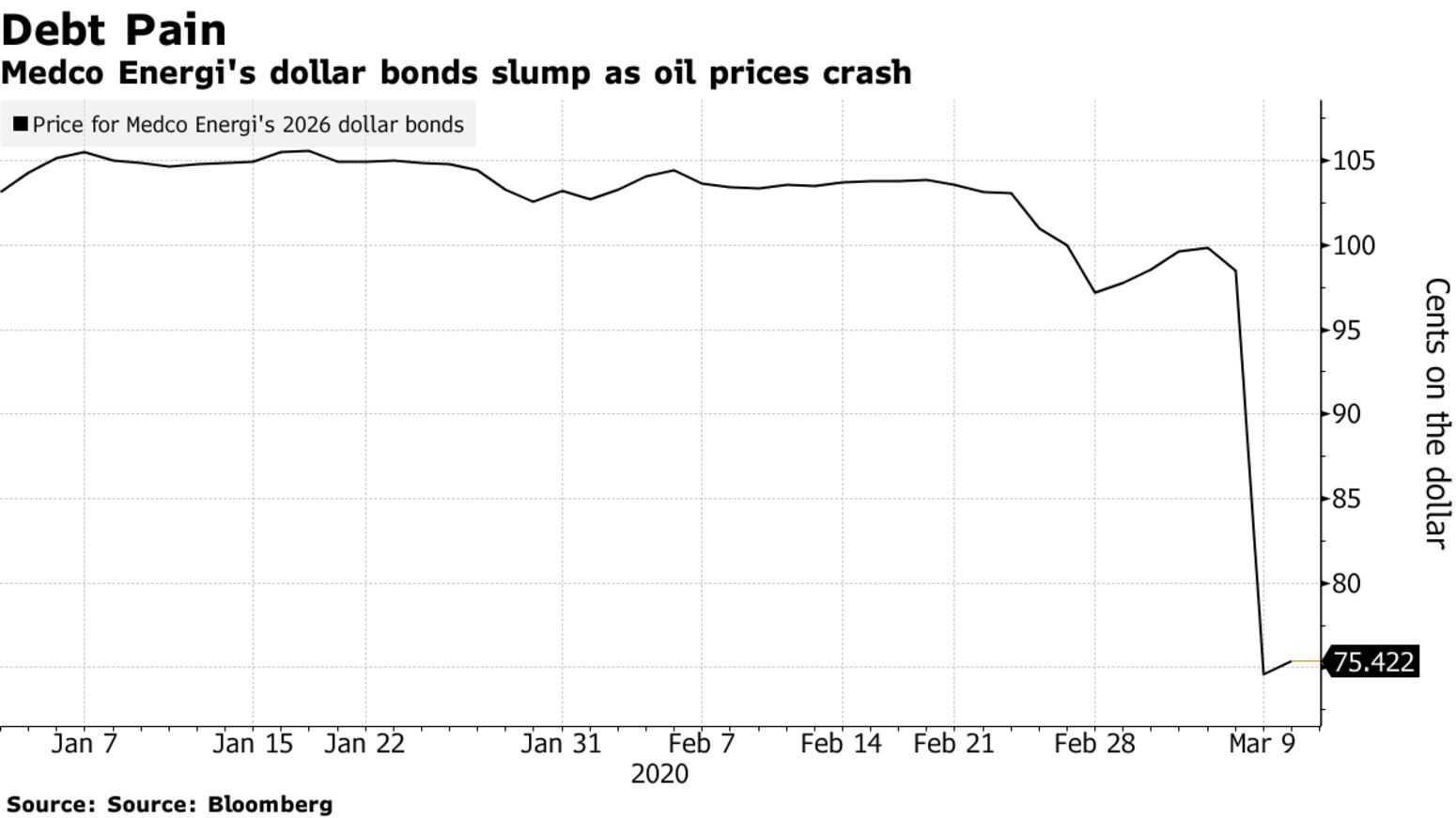

Oil explorers that have been on buying sprees and invested money into capital expenditure are exposed. In Asia, Indonesian oil firm Medco Energi Internasional was betting that oil prices would rise above $100 a barrel in a decade or so and planning to triple its oil and gas output. The company’s 2026 bonds slumped 25 cents on Monday to a record low of 73 and were at about 75 on Tuesday.

“Oil and commodities have been the first-order casualty in U.S. dollar Asia credit,” said Owen Gallimore, head of credit strategy at Australia & New Zealand Banking Group, adding that such bonds are showing a high correlation to the sharp sell-off in U.S. credit.