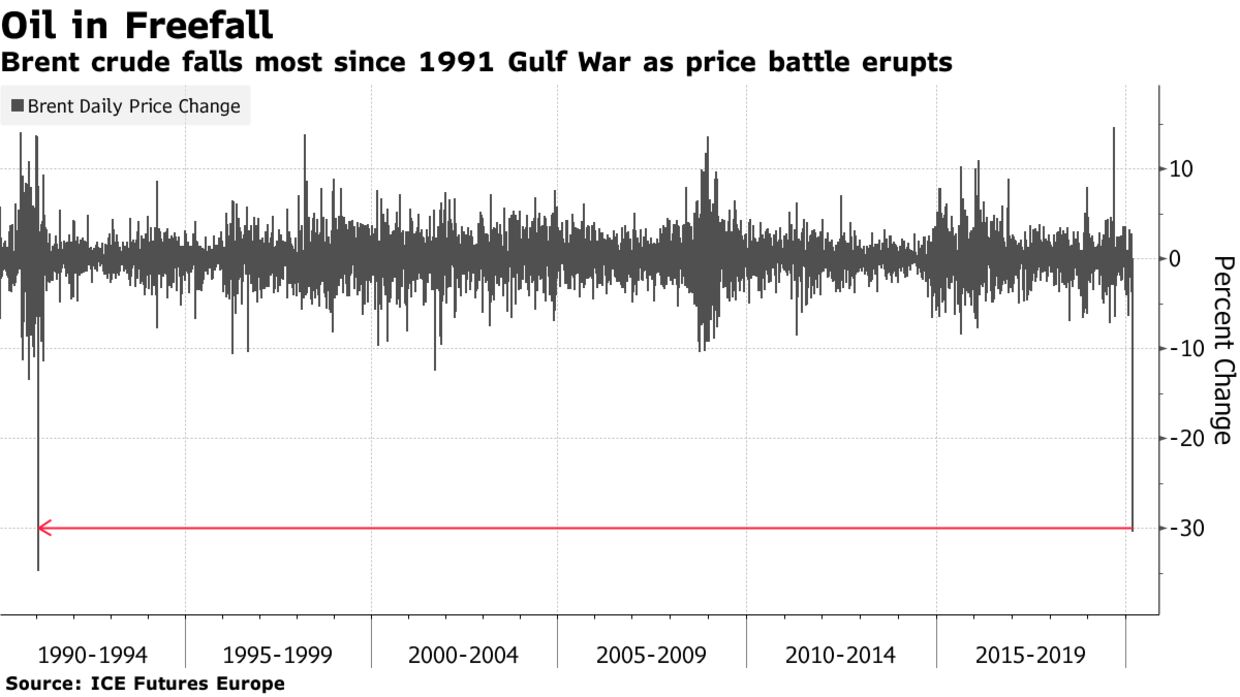

Oil markets crashed more than 30% after the disintegration of the OPEC+ alliance triggered an all-out price war between Saudi Arabia and Russia that is likely to have sweeping political and economic consequences. Brent futures suffered the second-largest decline on record in the opening seconds of trading in Asia, behind only the plunge during the Gulf War in 1991. As the global oil benchmark plummeted to as low as $31.02 a barrel, Goldman Sachs Group Inc. warned prices could drop to near $20.

The cataclysmic collapse will resonate through the energy industry, from giants like Exxon Mobil Corp. to smaller shale drillers in West Texas. It will hit the budgets of oil-dependent nations from Iraq to Nigeria and could also reshape global politics, eroding the influence of countries like Saudi Arabia. The fight against climate change may suffer a setback as fossil fuels become more competitive against renewable energy.

“It’s just a nightmare,” said Tamas Varga, an analyst at PVM Oil Associates Ltd. in London. “We have had a demand shock and now we have a supply shock as well. It’s unprecedented.” Brent for May settlement tumbled as much as $14.25 a barrel to $31.02 on the London-based ICE Futures Europe Exchange, the biggest intraday loss since the U.S.-led bombing of Iraq in January 1991. It was trading down 21% at $35.76 as of 10:12 a.m. local time.