Oil resumed its decline after the head of the International Energy Agency warned global demand was in ‘free fall’ as coronavirus lockdowns wreak havoc on consumption while major producers pump more. Futures in New York tumbled 7.7% in New York, dropping for the first time this week, after IEA executive director Fatih Birol said demand could drop as much as 20 million barrels a day. The gloomy outlook exacerbated investor pessimism driven by a U.S. decision to rescind a crude-buying offer after failing to win funding from Congress.

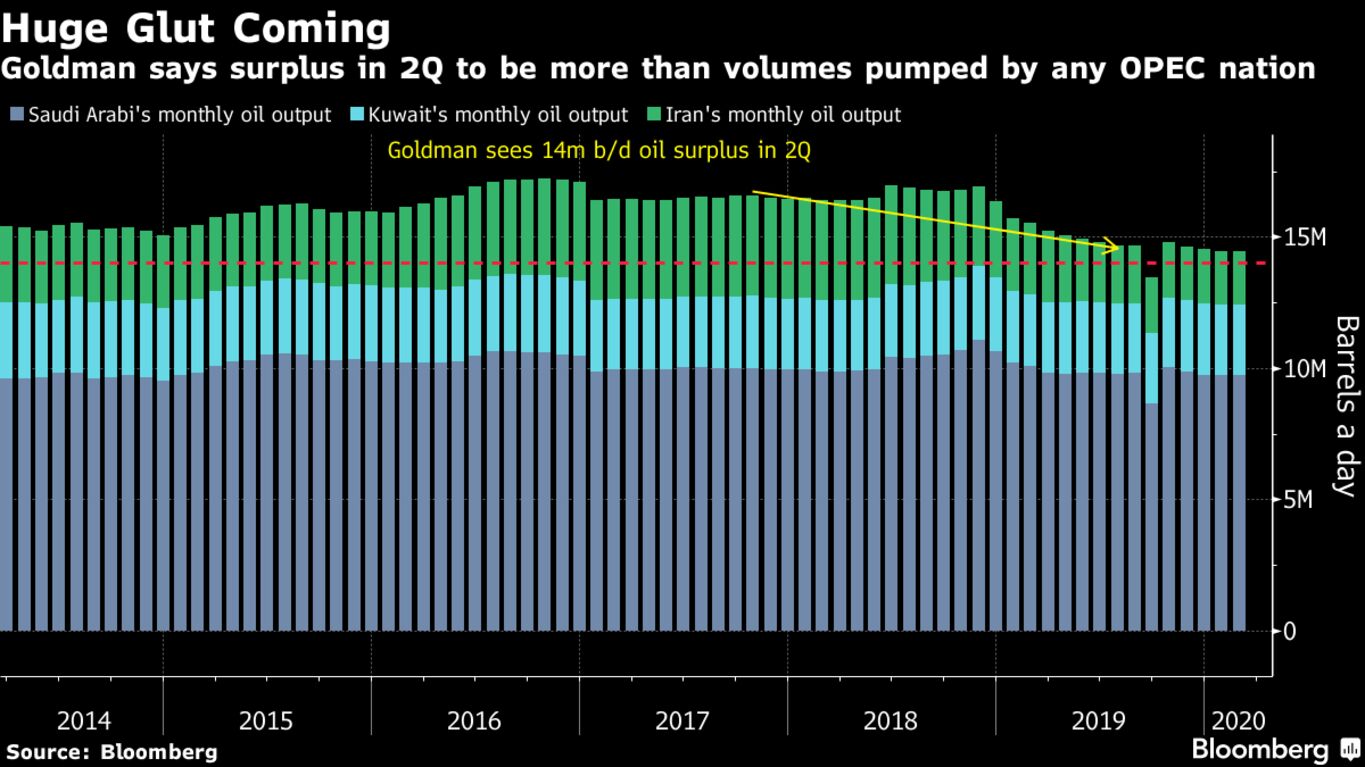

Market gauges have been signaling weakness, with key swaps in the North Sea plummeting, and U.S. traders and consultant IHS Markit raising alarms about storage space running out. Goldman Sachs Group Inc. also warned of a massive contraction in demand that not even a supply freeze or cut from OPEC could rectify. “We’ve never seen something like this before,” said Mike Hiley, president of OTC Futures. “Oil is going to continue to be stuck in this rut given the simultaneous supply and demand shocks. Stimulus doesn’t really help these issues. Just because people have more money in their pockets, doesn’t mean they’re getting in their cars.”

Falling crude prices were undeterred by the U.S. Senate approving a $2 trillion stimulus plan after days of intense negotiations. The House is under pressure to pass the bill quickly and send it to President Donald Trump for his signature as signs of weakness in the economy mount with American jobless claims surging to a record 3.28 million last week.